How Much Extra Must Women Save for a Secure Retirement?

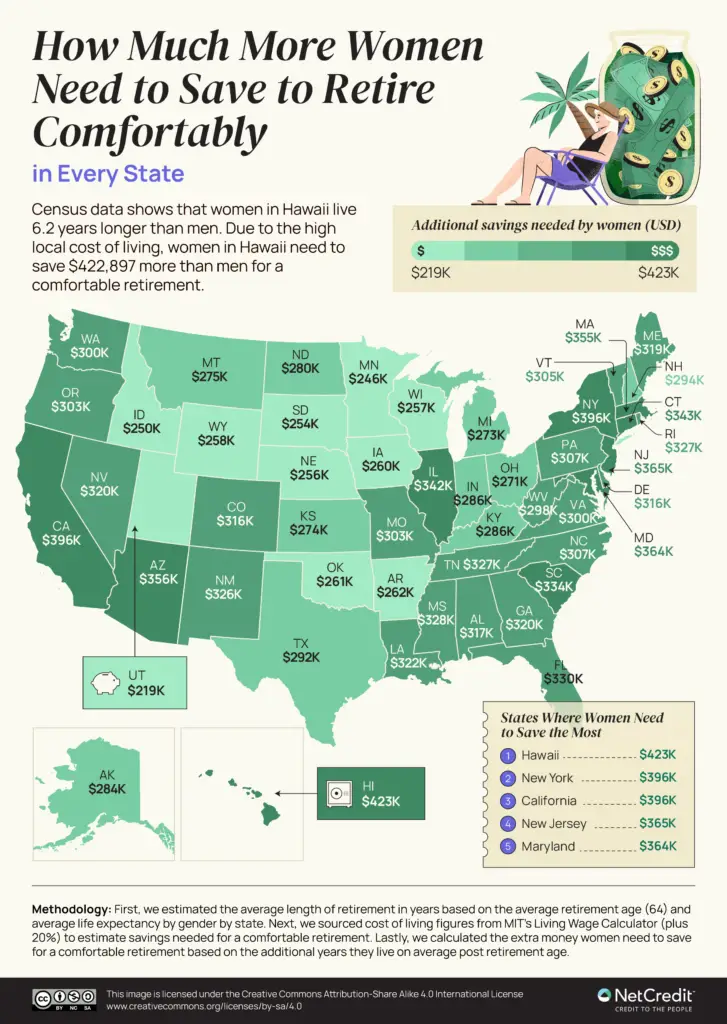

Retirement should be a time of peace and possibility. Yet for millions of American women, it’s becoming a financial minefield. As NetCredit reports, nearly 4.1 million Americans are preparing to retire this year, revealing a critical story of systemic challenges that threaten especially women’s financial futures.

The Silent Financial Struggle

Behind the statistics lies a deeply personal narrative of economic inequality. Women aren’t just earning less—they’re facing a complex web of financial challenges that compound over decades. The gender pay gap isn’t just about current earnings; it’s a lifelong journey that dramatically impacts retirement security.

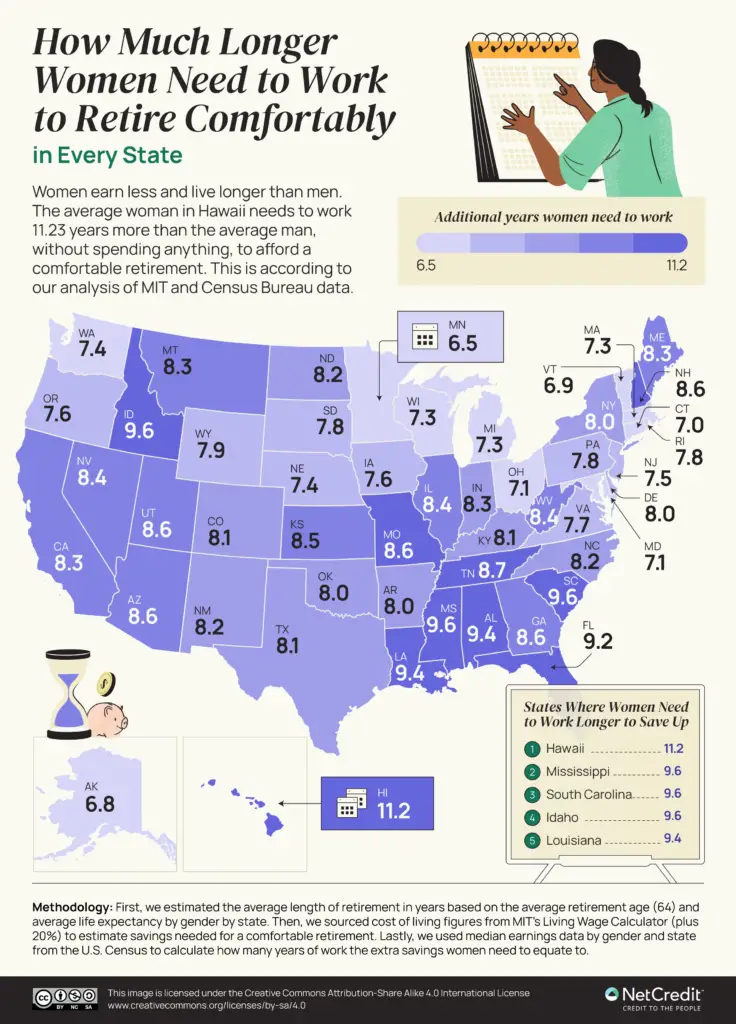

Consider the harsh realities: Women earn just 84% of what men earn, live six years longer, and are statistically more likely to interrupt their careers for caregiving. These aren’t just numbers—they’re real-life constraints that reshape financial trajectories.

Hawaii: The Retirement Savings Battleground

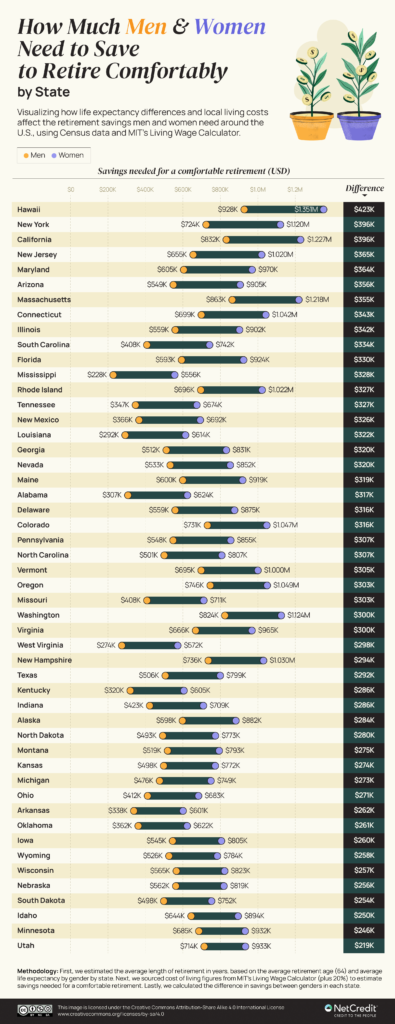

If retirement savings challenges had a poster child, it would be Hawaii. The state represents an extreme example of the broader national issue. Women in Hawaii need to save a staggering $1,350,542 for a comfortable retirement—the highest in the United States.

Hawaii’s unique demographic landscape creates perfect conditions for retirement complexity. Women here live an average of 19.8 years past retirement age, facing living costs of $68,209 annually. More critically, older women in Hawaii are more likely to be single, meaning they shoulder housing and living expenses alone. Approximately 13% of single older women in Hawaii live in poverty, compared to just 4.1% of married women.

The numbers tell a stark story: Women in Hawaii must work 11.23 years longer than men to reach their retirement savings goals. This isn’t just a statistic—it’s a testament to systemic economic challenges.

The Southeastern Retirement Dilemma

While Hawaii represents an extreme, the Southeastern United States presents its own retirement savings challenges. In states like Mississippi and South Carolina, women face nearly identical hurdles, needing to work approximately 9.63 years longer than men to build adequate retirement funds.

This isn’t a coincidence. Mississippi, which only enacted its equal pay law in 2022, symbolizes the ongoing struggle for workplace equity. These additional working years aren’t just time—they represent lost opportunities, delayed dreams, and continued economic pressure.

New York’s Complex Financial Landscape

New York offers another fascinating case study. Despite being a hub of economic opportunity, the state reveals deep-rooted financial inequalities. Women in New York need to save $1,119,795 for retirement—a whopping $395,616 more than their male counterparts.

New York State Attorney General Letitia James captures the essence of this challenge: “Being paid less can weaken a woman’s ability to provide for herself or save for retirement… The pay gap is even worse for women of color”.

A Generational Financial Pressure Cooker

Millennials aren’t immune to these challenges. Carrying an average of $30,558 in non-mortgage debt and facing housing costs that outpace wage increases, younger women confront an even more complex financial future.

Income strategist Diane Garnick offers a powerful perspective: “People wouldn’t go through an entire year without a physician’s checkup. Similarly, we need annual financial check-ups to ensure we’re on the right track”.

| State | Length for retirement for men (years) | Length for retirement for women (years) | Savings needed to retire comfortably for men | Savings needed to retire comfortably for women | Extra time women need to work to retire comfortably (yers) | Extra money women need to retire comfortably |

|---|---|---|---|---|---|---|

| Alabama | 6.1 | 12.4 | $306,789 | $623,636 | 9.37 | $316,847 |

| Alaska | 10.3 | 15.2 | $597,915 | $882,360 | 6.82 | $284,445 |

| Arizona | 9.4 | 15.5 | $549,077 | $905,392 | 8.58 | $356,316 |

| Arkansas | 7.1 | 12.6 | $338,448 | $600,627 | 7.99 | $262,178 |

| California | 12.2 | 18 | $831,918 | $1,227,420 | 8.26 | $395,502 |

| Colorado | 11.8 | 16.9 | $731,279 | $1,047,340 | 8.11 | $316,061 |

| Connecticut | 11.6 | 17.3 | $698,700 | $1,042,027 | 7.02 | $343,327 |

| Delaware | 9.9 | 15.5 | $559,120 | $875,390 | 7.95 | $316,270 |

| Florida | 10.6 | 16.5 | $593,324 | $923,571 | 9.15 | $330,247 |

| Georgia | 8.8 | 14.3 | $511,611 | $831,368 | 8.57 | $319,757 |

| Hawaii | 13.6 | 19.8 | $927,645 | $1,350,542 | 11.23 | $422,897 |

| Idaho | 12.1 | 16.8 | $644,194 | $894,419 | 9.56 | $250,224 |

| Illinois | 9.8 | 15.8 | $559,294 | $901,719 | 8.44 | $342,425 |

| Indiana | 8.3 | 13.9 | $423,400 | $709,067 | 8.26 | $285,667 |

| Iowa | 10.9 | 16.1 | $545,148 | $805,219 | 7.59 | $260,071 |

| Kansas | 9.8 | 15.2 | $3497.883 | $5772.227 | 8.52 | $5274.344 |

| Kentucky | 6.6 | 12.5 | $319,612 | $605,325 | 8.09 | $285,713 |

| Louisiana | 5.9 | 12.4 | $291,930 | $613,547 | 9.4 | $321,617 |

| Maine | 10.9 | 16.7 | $599,640 | $918,714 | 8.3 | $319,074 |

| Maryland | 9.8 | 15.7 | $605,170 | $969,506 | 7.12 | $364,337 |

| Massachusetts | 12.4 | 17.5 | $863,174 | $1,218,189 | 7.33 | $355,015 |

| Michigan | 9.4 | 14.8 | $475,869 | $749,241 | 7.3 | $273,372 |

| Minnesota | 12 | 17.4 | $605,455 | $931,791 | 6.47 | $246,336 |

| Mississippi | 4.6 | 11.2 | $228,313 | $555,892 | 9.63 | $327,579 |

| Missouri | 8.1 | 14.1 | $408,473 | $711,046 | 8.62 | $302,573 |

| Montana | 10.2 | 15.6 | $518,658 | $793,241 | 8.34 | $274,584 |

| Nebraska | 11.2 | 16.3 | $562,451 | $818,566 | 7.41 | $256,116 |

| Nevada | 9.5 | 15.2 | $532,688 | $852,300 | 8.35 | $319,613 |

| New Hampshire | 12.5 | 17.5 | $736,675 | $1,029,945 | 8.62 | $294,270 |

| New Jersey | 10.6 | 16.5 | $655,131 | $1,019,779 | 7.5 | $364,648 |

| New Mexico | 7.3 | 13.8 | $366,229 | $692,324 | 8.24 | $326,095 |

| New York | 10.8 | 16.7 | $724,179 | $1,119,795 | 7.97 | $395,616 |

| North Carolina | 9.3 | 15 | $500,504 | $807,264 | 8.2 | $306,760 |

| North Dakota | 10.2 | 16 | $492,807 | $773,030 | 8.15 | $280,224 |

| Ohio | 8.5 | 14.1 | $411,662 | $682,874 | 7.13 | $271,212 |

| Oklahoma | 7.5 | 12.9 | $361,899 | $622,466 | 7.97 | $260,567 |

| Oregon | 12.3 | 17.3 | $746,162 | $1,049,480 | 7.61 | $303,318 |

| Pennsylvania | 10 | 15.6 | $547,932 | $854,774 | 7.78 | $306,842 |

| Rhode Island | 11.5 | 16.9 | $695,768 | $1,022,477 | 7.82 | $326,709 |

| South Carolina | 7.7 | 14 | $407,964 | $741,754 | 9.63 | $333,789 |

| South Dakota | 10.2 | 15.4 | $498,388 | $752,469 | 7.82 | $254,080 |

| Tennessee | 6.7 | 13 | $347,296 | $673,858 | 8.66 | $326,562 |

| Texas | 9.7 | 15.3 | $506,433 | $798,807 | 8.13 | $292,374 |

| Utah | 12.7 | 16.6 | $713,994 | $933,252 | 8.58 | $219,258 |

| Vermont | 12.1 | 17.4 | $695,392 | $999,985 | 6.89 | $304,593 |

| Virginia | 11.1 | 16.1 | $665,640 | $965,478 | 7.67 | $299,838 |

| Washington | 12.9 | 17.6 | $824,186 | $1,124,471 | 7.39 | $300,285 |

| West Virginia | 5.8 | 12.1 | $274,127 | $571,885 | 8.44 | $297,758 |

| Wisconsin | 11.2 | 16.3 | $565,313 | $822,733 | 7.34 | $257,419 |

| Wyoming | 10 | 14.9 | $525,876 | $783,555 | 7.88 | $257,679 |

Beyond the Numbers: Pathways to Financial Empowerment

The retirement savings gap is more than a statistical anomaly—it’s a systemic challenge that requires multi-dimensional solutions. Financial education, workplace policy reforms, and individual strategic planning can create meaningful change.

For women, this means:

- Prioritizing consistent retirement contributions

- Seeking professional financial advice

- Negotiating salaries and understanding workplace value

- Creating backup financial strategies

- Supporting policies that address wage inequalities

Each strategy represents a step toward breaking the cycle of financial vulnerability and creating a more secure future.

Methodology

The analysis combined data from multiple sources:

- MIT’s Living Wage Calculator

- U.S. Census Bureau earnings data

- State-specific life expectancy statistics

Disclaimer: These calculations illustrate financial disparities and should not be used as definitive retirement planning tools.