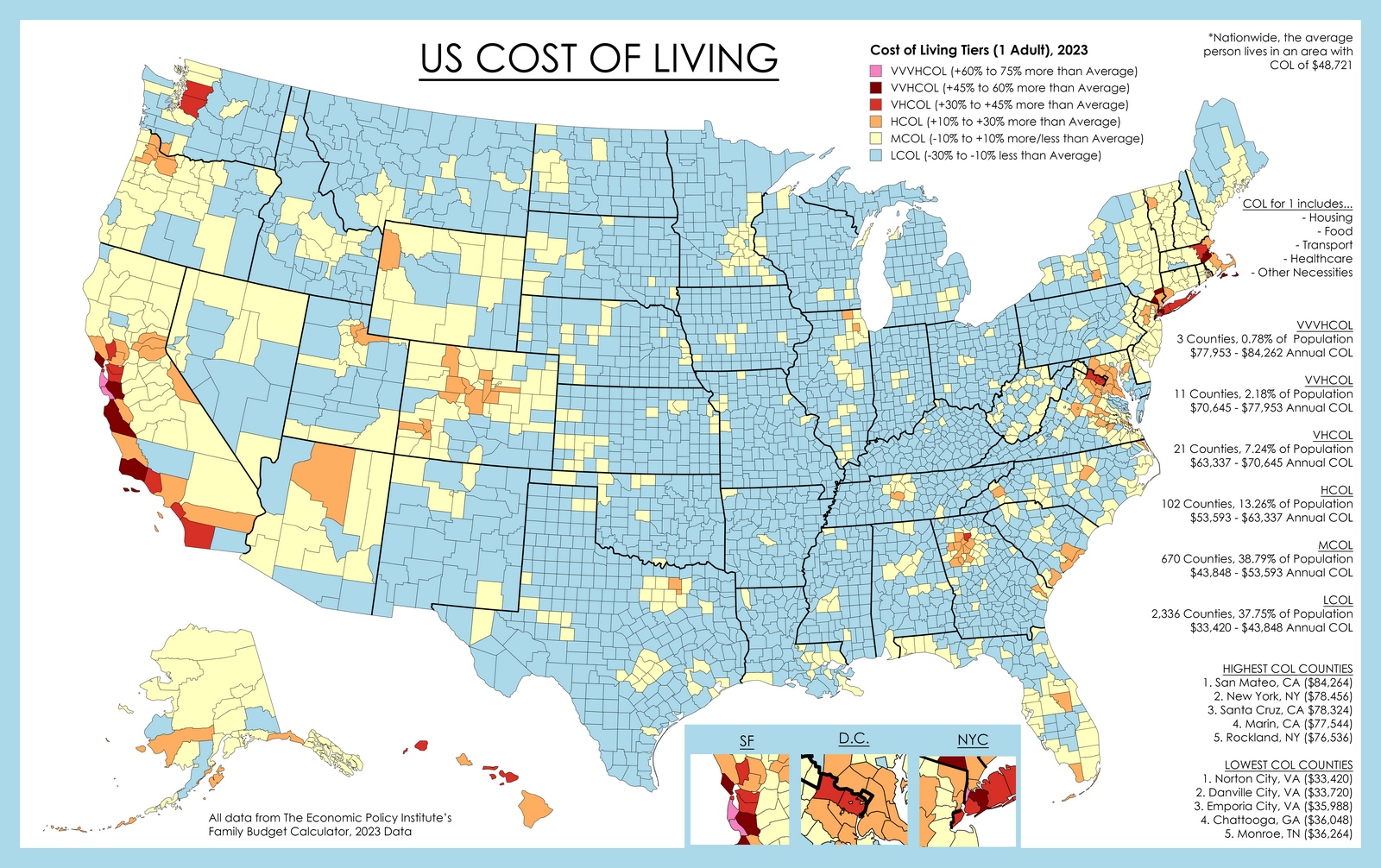

How Much Money You Need To Save To Retire Early In Every U.S. State

Despite being close to retirement age, many Americans have a hard time conceptualizing retirement. Many people are unaware of the amount they require for retirement, let alone early retirement.

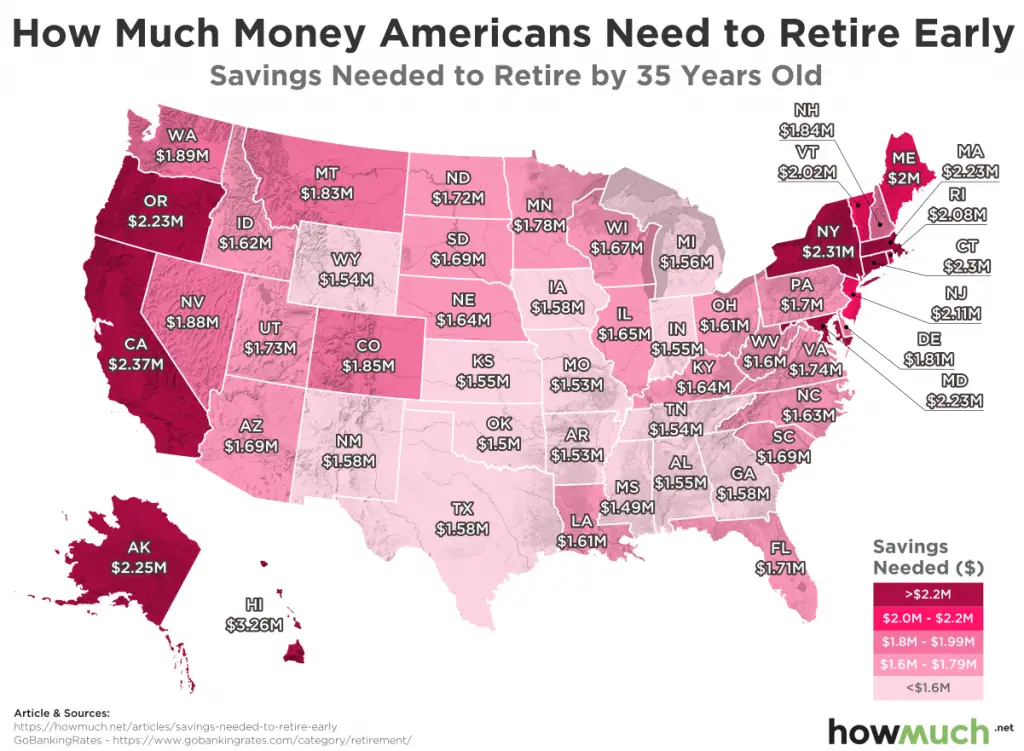

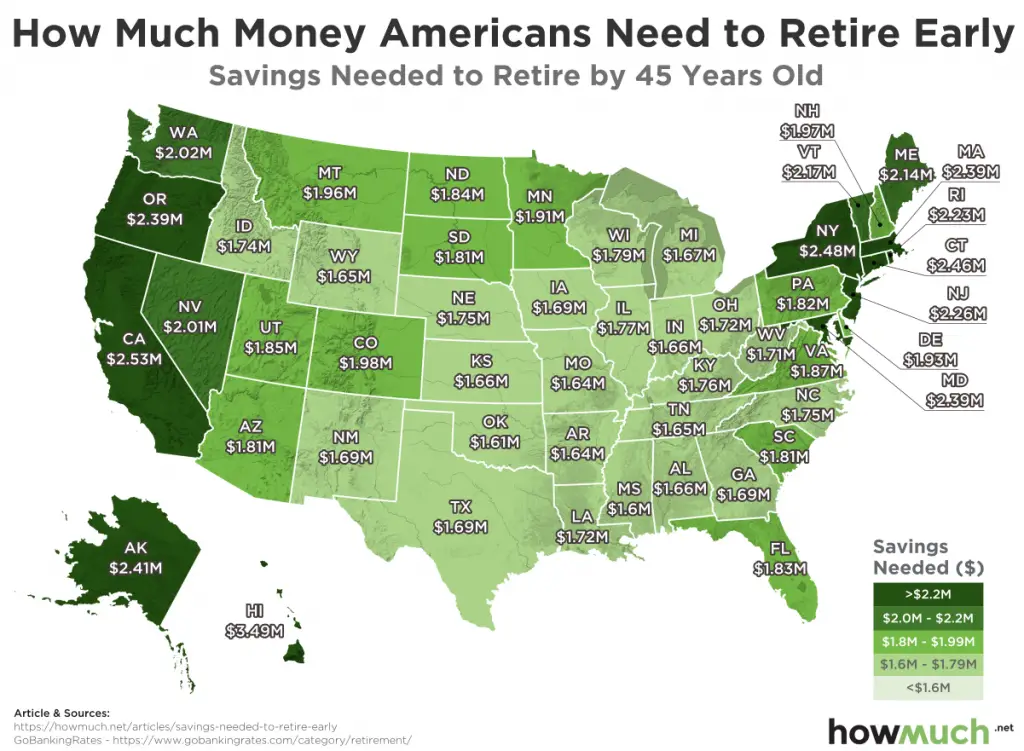

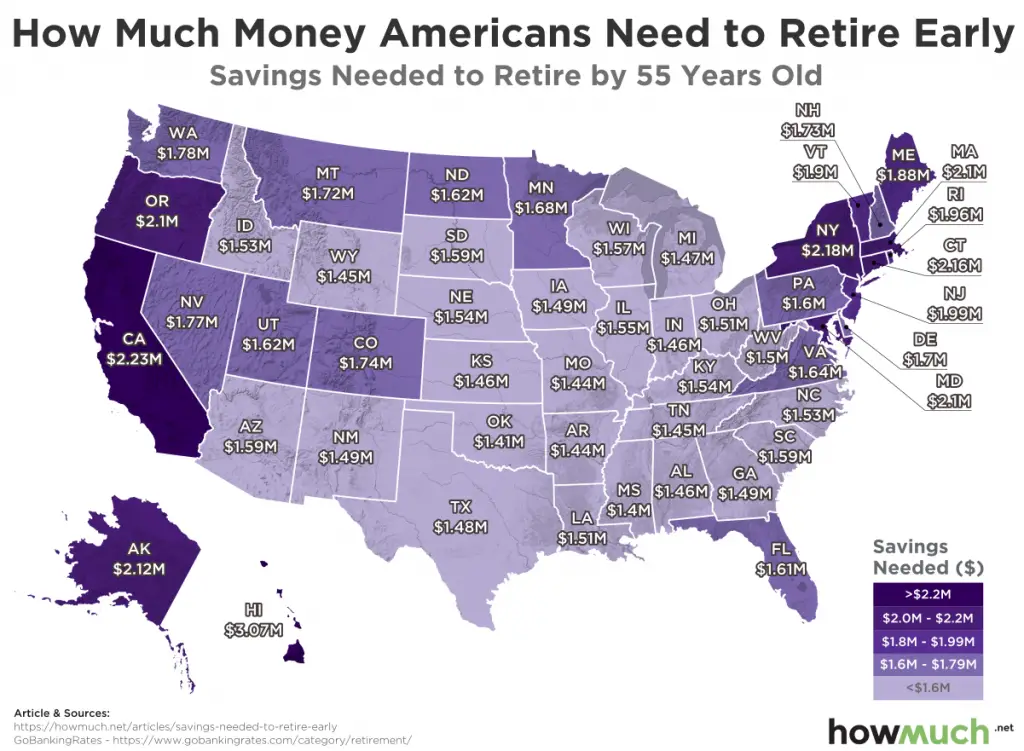

Below are the maps created by howmuch.net using GoBankingRates data that show how much money you need to save to retire early in every American State.

The average retirement age in the United States is 61. That means about 40 years in the workforce for the average retiree. But what if you wanted to cash out earlier?

Savings needed to retire by 35 years old

Savings needed to retire by 45 years old

Savings needed to retire by 55 years old

| State | Amount Needed to Retire by 35 ($) | Amount Needed to Retire by 45 ($) | Amount Needed to Retire by 55 ($) |

|---|---|---|---|

| ALABAMA | 1,546,362 | 1,655,472 | 1,455,373 |

| ALASKA | 2,252,234 | 2,411,151 | 2,119,712 |

| ARIZONA | 1,689,607 | 1,808,825 | 1,590,190 |

| ARKANSAS | 1,527,377 | 1,635,148 | 1,437,506 |

| CALIFORNIA | 2,367,866 | 2,534,942 | 2,228,540 |

| COLORADO | 1,851,837 | 1,982,502 | 1,742,874 |

| CONNECTICUT | 2,295,381 | 2,457,341 | 2,160,319 |

| DELAWARE | 1,806,965 | 1,934,463 | 1,700,642 |

| FLORIDA | 1,710,317 | 1,830,996 | 1,609,681 |

| GEORGIA | 1,580,879 | 1,692,425 | 1,487,859 |

| HAWAII | 3,260,131 | 3,490,164 | 3,068,303 |

| IDAHO | 1,622,299 | 1,736,768 | 1,526,842 |

| ILLINOIS | 1,651,638 | 1,768,177 | 1,554,455 |

| INDIANA | 1,553,265 | 1,662,863 | 1,461,870 |

| IOWA | 1,579,153 | 1,690,577 | 1,486,235 |

| KANSAS | 1,551,539 | 1,661,015 | 1,460,246 |

| KENTUCKY | 1,639,558 | 1,755,244 | 1,543,085 |

| LOUISIANA | 1,606,766 | 1,720,139 | 1,512,223 |

| MAINE | 2,000,260 | 2,141,397 | 1,882,564 |

| MARYLAND | 2,231,524 | 2,388,979 | 2,100,220 |

| MASSACHUSETTS | 2,229,798 | 2,387,132 | 2,098,596 |

| MICHIGAN | 1,556,717 | 1,666,558 | 1,465,119 |

| MINNESOTA | 1,781,077 | 1,906,749 | 1,676,278 |

| MISSISSIPPI | 1,491,134 | 1,596,348 | 1,403,395 |

| MISSOURI | 1,529,103 | 1,636,996 | 1,439,130 |

| MONTANA | 1,827,675 | 1,956,635 | 1,720,134 |

| NEBRASKA | 1,636,106 | 1,751,549 | 1,539,836 |

| NEVADA | 1,877,725 | 2,010,216 | 1,767,238 |

| NEW HAMPSHIRE | 1,839,756 | 1,969,568 | 1,731,504 |

| NEW JERSEY | 2,110,715 | 2,259,645 | 1,986,519 |

| NEW MEXICO | 1,579,153 | 1,690,577 | 1,486,235 |

| NEW YORK | 2,312,639 | 2,475,818 | 2,176,562 |

| NORTH CAROLINA | 1,630,928 | 1,746,006 | 1,534,964 |

| NORTH DAKOTA | 1,718,947 | 1,840,235 | 1,617,803 |

| OHIO | 1,605,041 | 1,718,291 | 1,510,599 |

| OKLAHOMA | 1,503,215 | 1,609,281 | 1,414,765 |

| OREGON | 2,233,250 | 2,390,827 | 2,101,844 |

| PENNSYLVANIA | 1,698,236 | 1,818,063 | 1,598,311 |

| RHODE ISLAND | 2,084,827 | 2,231,931 | 1,962,154 |

| SOUTH CAROLINA | 1,687,881 | 1,806,977 | 1,588,565 |

| SOUTH DAKOTA | 1,691,333 | 1,810,673 | 1,591,814 |

| TENNESSEE | 1,542,910 | 1,651,777 | 1,452,124 |

| TEXAS | 1,577,427 | 1,688,729 | 1,484,610 |

| UTAH | 1,725,850 | 1,847,625 | 1,624,300 |

| VERMONT | 2,022,696 | 2,165,417 | 1,903,680 |

| VIRGINIA | 1,744,834 | 1,867,949 | 1,642,167 |

| WASHINGTON | 1,886,354 | 2,019,454 | 1,775,360 |

| WEST VIRGINIA | 1,596,411 | 1,709,053 | 1,502,478 |

| WISCONSIN | 1,670,623 | 1,788,501 | 1,572,322 |

| WYOMING | 1,537,732 | 1,646,234 | 1,447,251 |

According to these maps, you might not require as much money as you think to retire early. If you’re 35 years old, you may be able to retire with only $1.5 million, depending on your location.

Mississippi is the ideal state for early retirees, but Hawaii, California, and New York are too costly.

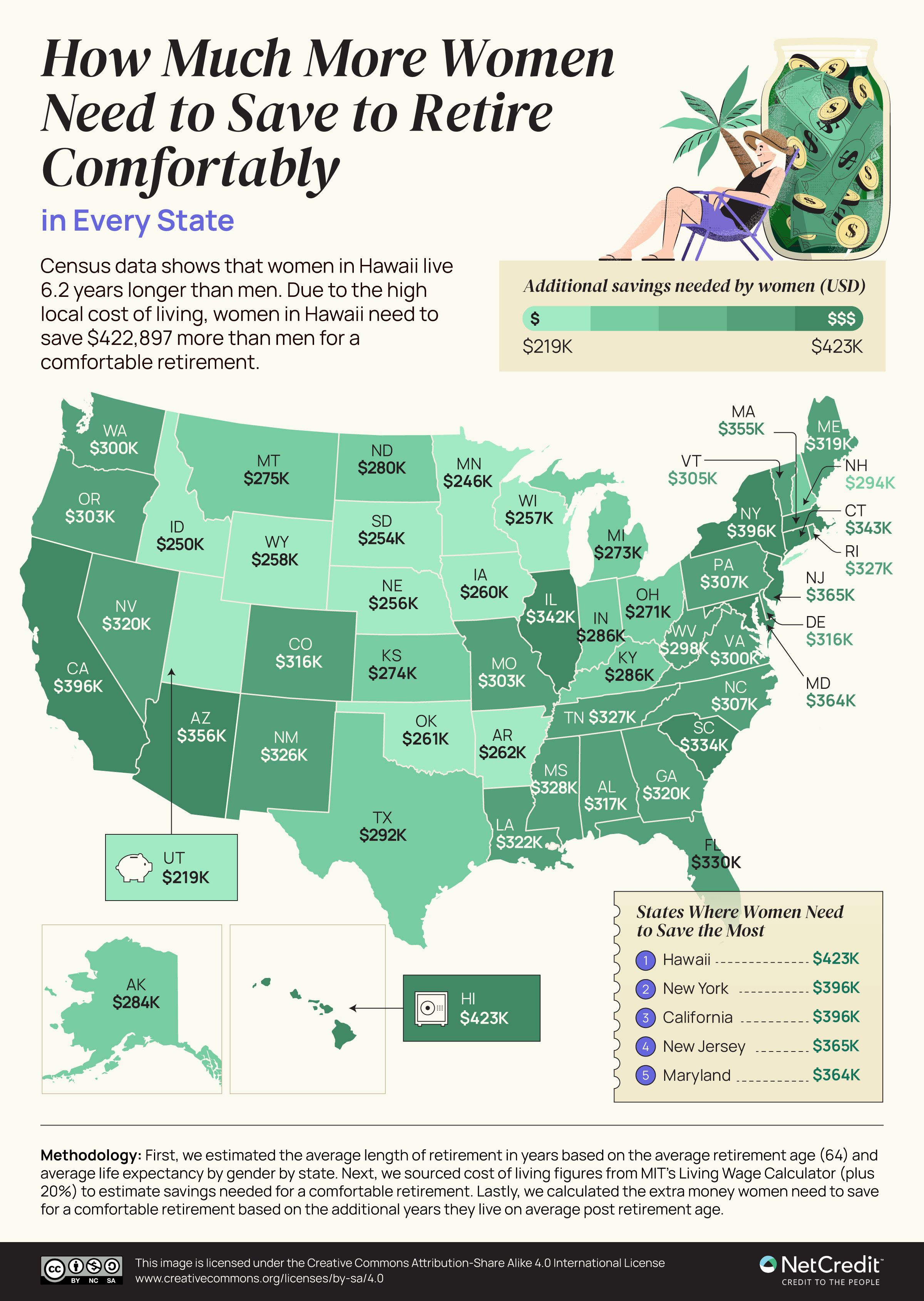

Of course, my state Hawaii is the worst…

.

The cost of living is the highest because of regressive taxes, government spending and bad business environment

The last category ” < $1.6 mil " has no data for it. It would be good to drop that category.