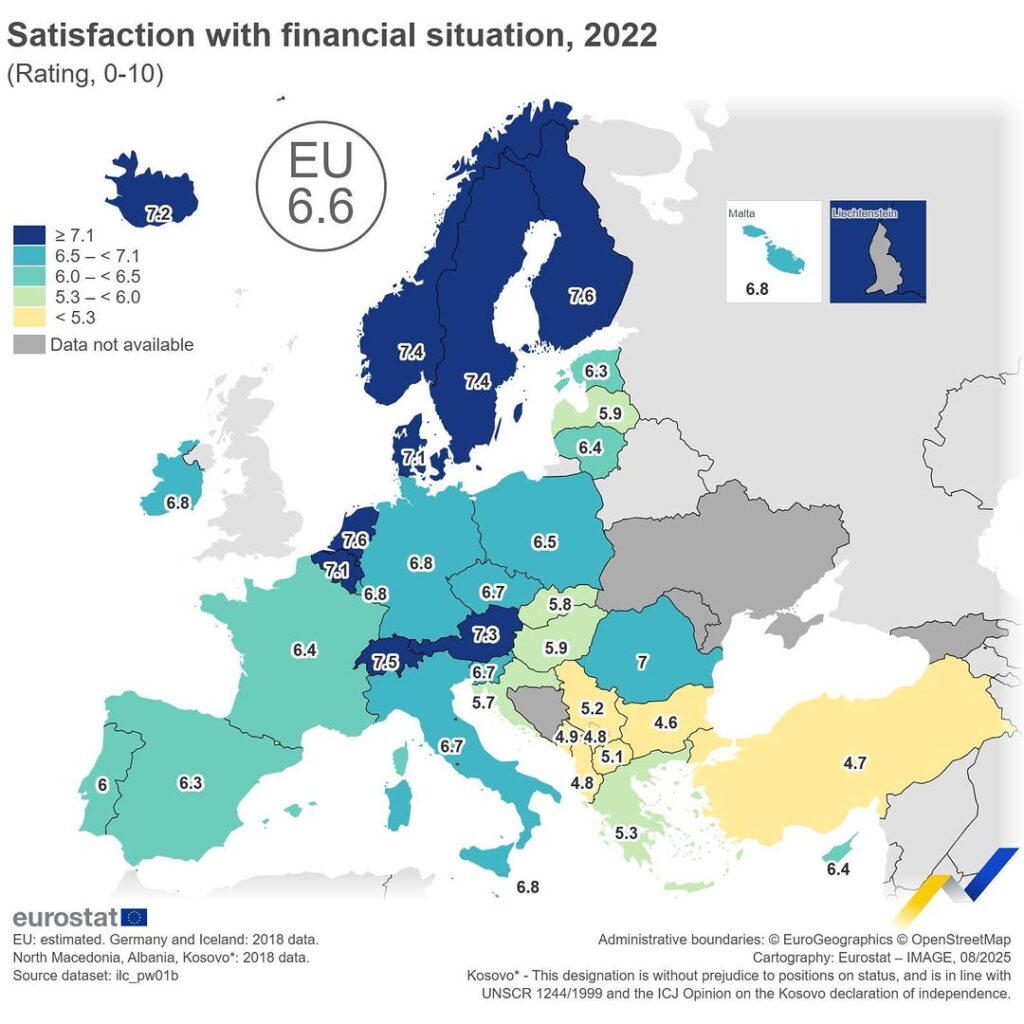

Financial satisfaction in Europe — how people judge their household finances

Financial satisfaction is the short answer people give when asked whether their household money situation is comfortable — whether bills are manageable, small emergencies can be handled, and there’s a little room to save. It’s a subjective measure on a 0–10 scale that mixes immediate conditions (wages, bills, debt) with expectations about the future.

Several practical forces shape that single score. Household income and how far it goes after housing, energy and transport costs are obvious factors; job stability and the quality of work matter too, because steady contracts and predictable hours reduce uncertainty in ways that short-term pay increases do not. Public services and social transfers cushion households against shocks, and household wealth, debt and the ability to save change how people feel about “enough.” Education and local expectations also tilt responses: attainment opens access to different jobs and changes what people count as a secure standard of living. Finally, the share of national income that reaches lower-income households has a clear influence on how many people feel secure.

The map below shows the income share of the bottom 40% and makes clear how income distribution relates to financial satisfaction. It’s based on Eurostat’s 2017 data; although the map is older, the same countries still have the lowest Gini coefficients.

The Netherlands and Finland are near the top of the table – people there tend to report fewer money worries, which fits with relatively steady jobs and wide-ranging public services. Sweden and Austria show much the same pattern. At the other end, Bulgaria’s average is notably lower: lower typical incomes and greater exposure to shocks make it harder for many households to feel financially secure. These are broad strokes — local prices, recent jumps in inflation or energy bills, and what people expect from work and family life all change how those numbers play out in daily reality.