Where the World’s Millionaires Live

It’s easy to forget how unequal global wealth really is—until you look at the numbers. Today, there are about 58 million millionaires around the world. That’s less than 1.2% of the global adult population, yet they collectively own nearly 47% of all household wealth—roughly $213 trillion, according to UBS’s Global Wealth Report.

Most millionaires aren’t jet-setting billionaires. Many just crossed that threshold with rising property values or years of saving. But where do they all live? And has that changed much in the last few years?

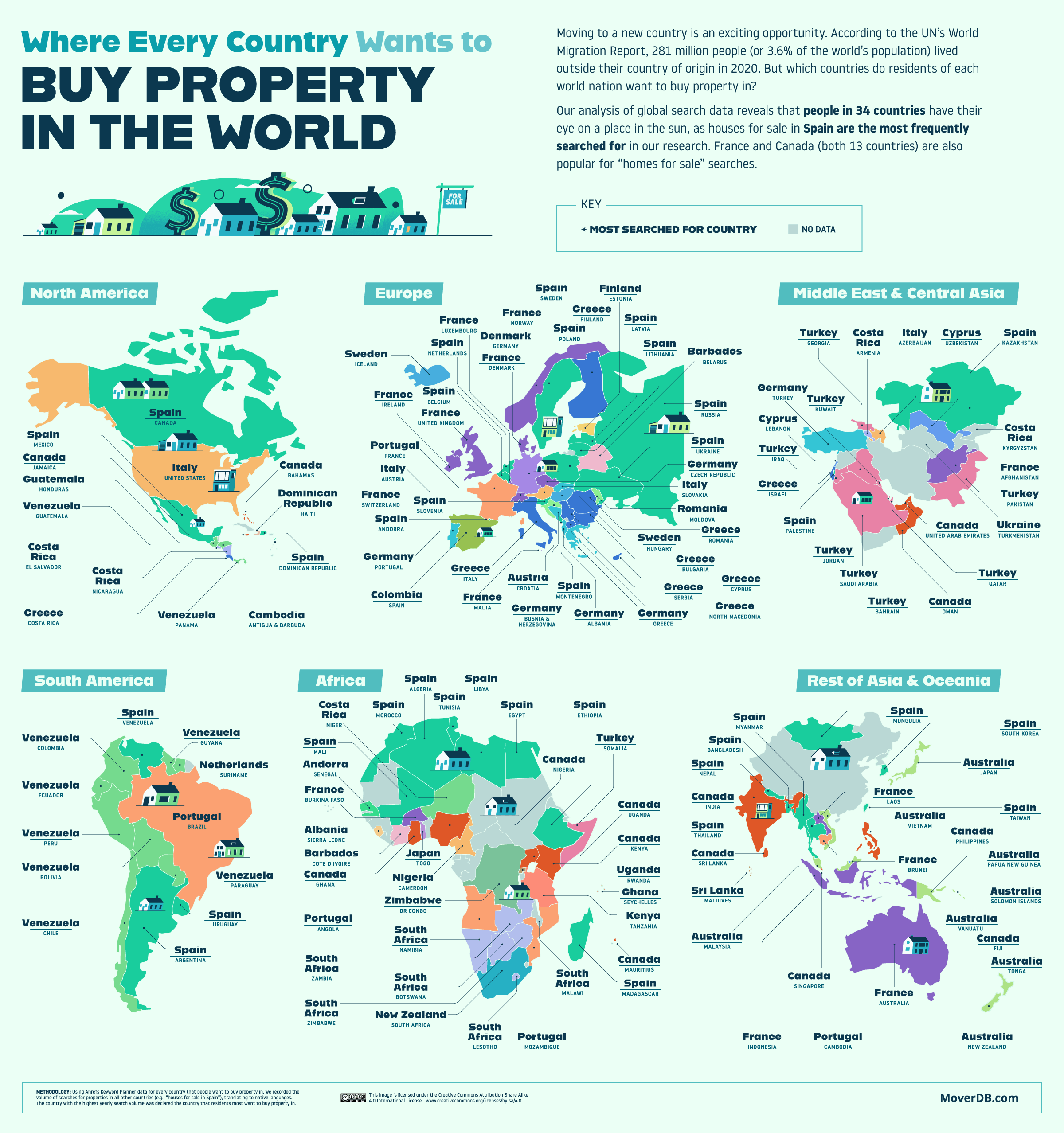

Let’s take a closer look at where millionaires were clustered back in 2019, and how that distribution looks now in 2024.

Back in 2019: The Pre-COVID Wealth Map

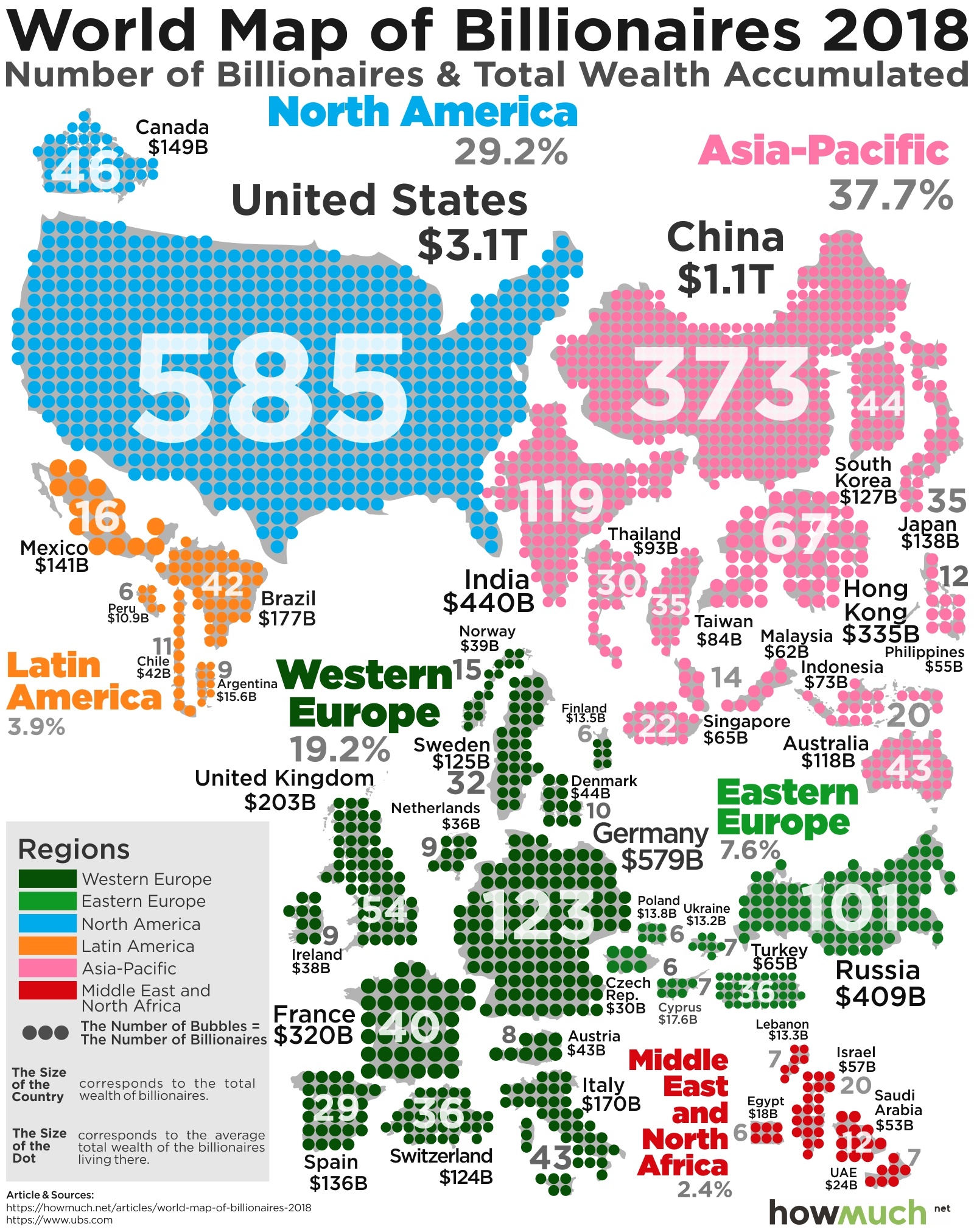

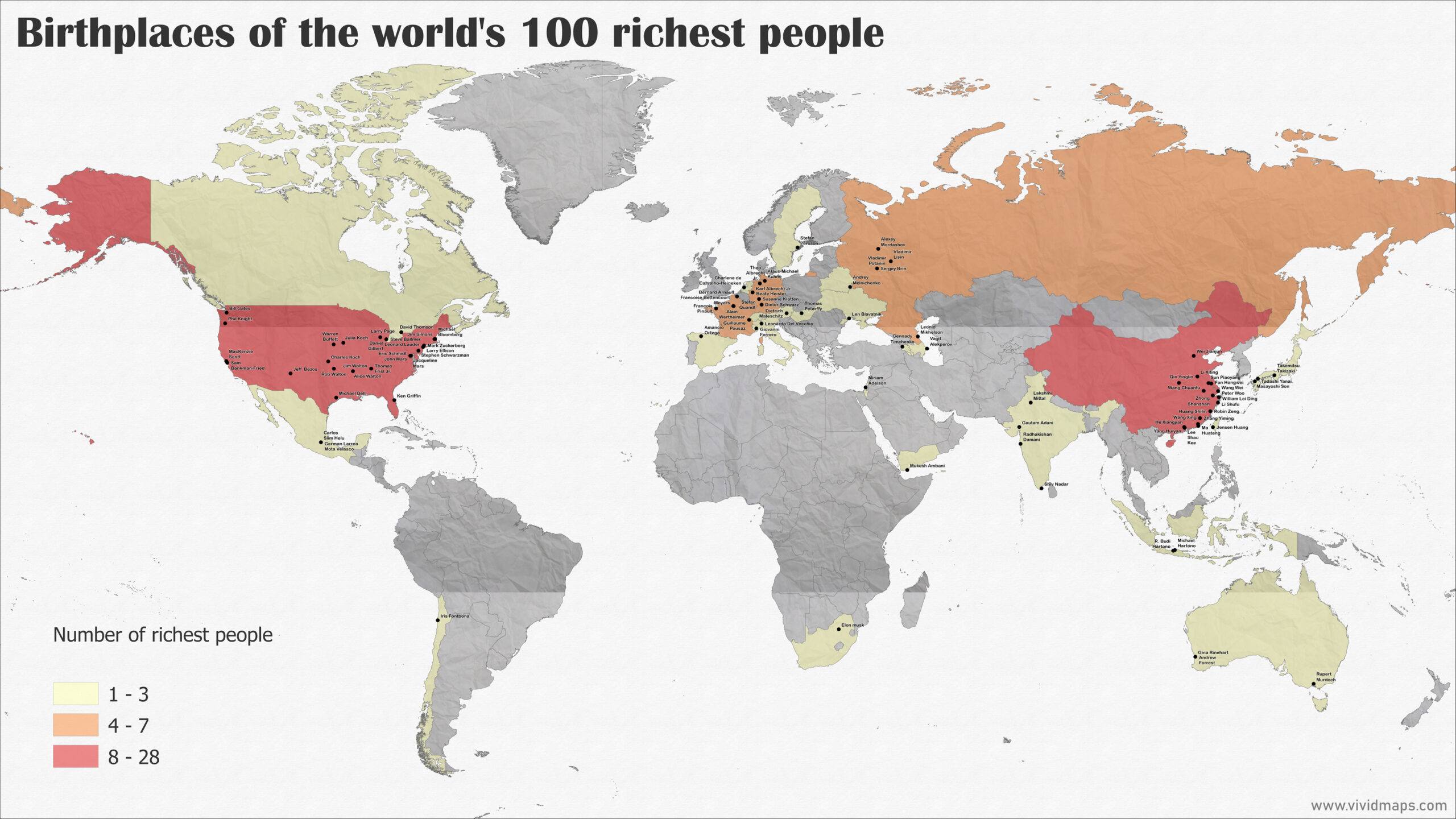

Before the pandemic, the global millionaire population was estimated at just under 47 million. About 40% of them lived in the United States—more than four times the number in second-place China. Most other millionaires were concentrated in developed countries with long-established middle and upper classes.

Here’s what the global ranking looked like back then:

Top 25 Countries in 2019 (Millionaires in thousands)

| Rank | Country | Millionaires (2019) |

|---|---|---|

| 1 | United States | 18,614,000 |

| 2 | China | 4,447,000 |

| 3 | Japan | 3,025,000 |

| 4 | United Kingdom | 2,460,000 |

| 5 | Germany | 2,187,000 |

| 6 | France | 2,071,000 |

| 7 | Italy | 1,496,000 |

| 8 | Canada | 1,322,000 |

| 9 | Australia | 1,180,000 |

| 10 | Spain | 979,000 |

| 11 | Netherlands | 810,000 |

| 12 | Switzerland | 810,000 |

| 13 | India | 759,000 |

| 14 | South Korea | 741,000 |

| 15 | Taiwan | 528,000 |

| 16 | Hong Kong | 516,000 |

| 17 | Sweden | 374,000 |

| 18 | Austria | 313,000 |

| 19 | Belgium | 279,000 |

| 20 | Brazil | 259,000 |

| 21 | Russia | 246,000 |

| 22 | Denmark | 237,000 |

| 23 | Singapore | 207,000 |

| 24 | New Zealand | 185,000 |

| 25 | Mexico | 173,000 |

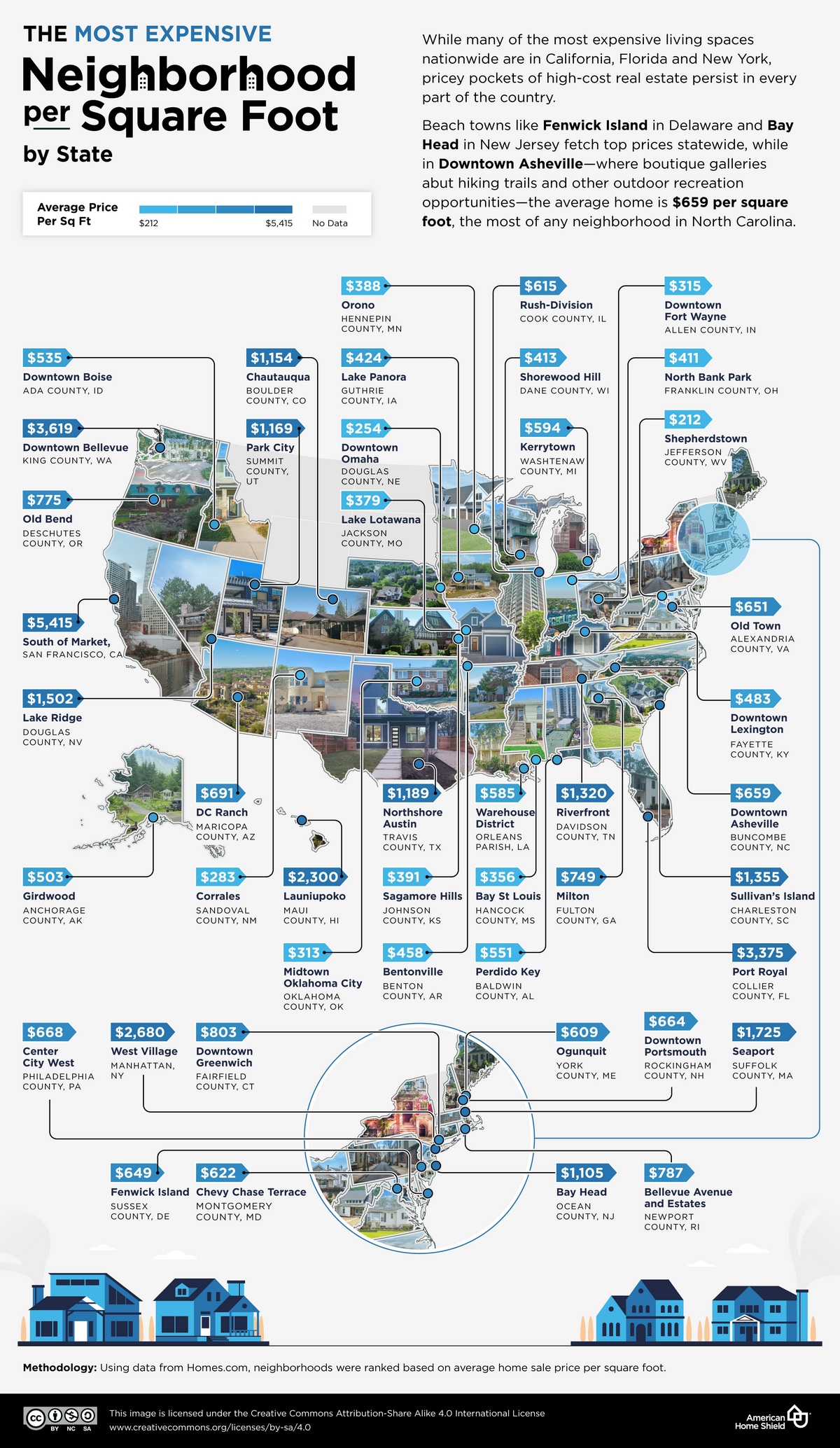

Fast Forward to 2024: What’s Changed?

After the pandemic, a lot of things shifted—markets bounced, inflation spiked, and real estate values took off in many countries. That led to a jump in the number of people reaching millionaire status.

Here’s how the top 25 list looks now, based on 2024 data from DataPandas.org:

Top 25 Countries in 2024 (Millionaires)

| Rank | Country | Millionaires (2024) |

|---|---|---|

| 1 | United States | 24,500,000 |

| 2 | China | 6,200,000 |

| 3 | Japan | 3,400,000 |

| 4 | United Kingdom | 2,800,000 |

| 5 | France | 2,800,000 |

| 6 | Germany | 2,700,000 |

| 7 | Canada | 2,300,000 |

| 8 | Australia | 2,200,000 |

| 9 | Italy | 1,400,000 |

| 10 | South Korea | 1,300,000 |

| 11 | Switzerland | 1,200,000 |

| 12 | Netherlands | 1,100,000 |

| 13 | Spain | 1,100,000 |

| 14 | Taiwan | 869,000 |

| 15 | India | 796,000 |

| 16 | Hong Kong | 632,000 |

| 17 | Sweden | 610,000 |

| 18 | Belgium | 589,000 |

| 19 | Denmark | 385,000 |

| 20 | Russia | 353,000 |

| 21 | New Zealand | 347,000 |

| 22 | Mexico | 318,000 |

| 23 | Saudi Arabia | 313,000 |

| 24 | Singapore | 299,000 |

| 25 | Austria | 271,000 |

Why Some Countries Gained More Than Others

The U.S. continues to lead by a wide margin—about 42% of all millionaires worldwide live there. That number grew by nearly 6 million since 2019, driven by market gains, housing prices, and post-pandemic recovery.

China also saw a sharp rise in new millionaires, thanks to urban development, tech startups, and the rise of private wealth, though that growth has started to cool recently.

France, the UK, and Canada all moved up slightly in rank. Meanwhile, Italy and Russia lost some ground, not because they’re getting poorer necessarily, but because their millionaire growth just didn’t keep pace with other countries.

Singapore is an interesting case. It doesn’t even crack the top 20 in terms of population, but it now has nearly 300,000 millionaires. It’s a popular destination for wealthy investors, thanks to low taxes and political stability.

The Bigger Picture

So, what does all this mean? For one, it shows how tightly linked national economies are to personal wealth. Countries with stable financial systems, strong real estate markets, and tech innovation tend to produce more millionaires, at least in the current era.

It also reminds us that while the number of millionaires is growing, wealth is still extremely concentrated. Over 99% of adults worldwide aren’t millionaires, and half the planet owns less than 1% of total wealth.

Still, it’s useful to track where wealth is moving. It helps us understand global economic trends, and it says something about where people see opportunities to build and keep wealth.

Got thoughts about this shift? Surprised by which countries climbed or fell? Drop your comment below—I’d love to hear what stood out to you.