A Guide to Identity Theft Statistics for 2022

There is a digital counterpart for almost everything we do, which means more of our confidential information is online. And although this creates our lives more comfortable, it unlocks the door for information to land in the evil hands. Identity theft happens when someone uses your personally identifiable information for monetary or personal gain. Sensitive data like credit card numbers and Social Security numbers can be precious if it gets into the wrong hands.

The promising news is that you can take action to minimize the risk of identity theft. This essay breaks down some of the most exciting fraud statistics and trends about identity theft in the U.S. and suggests methods to protect your private data from cybercriminals.

Table of Contents

Identity theft by the numbers

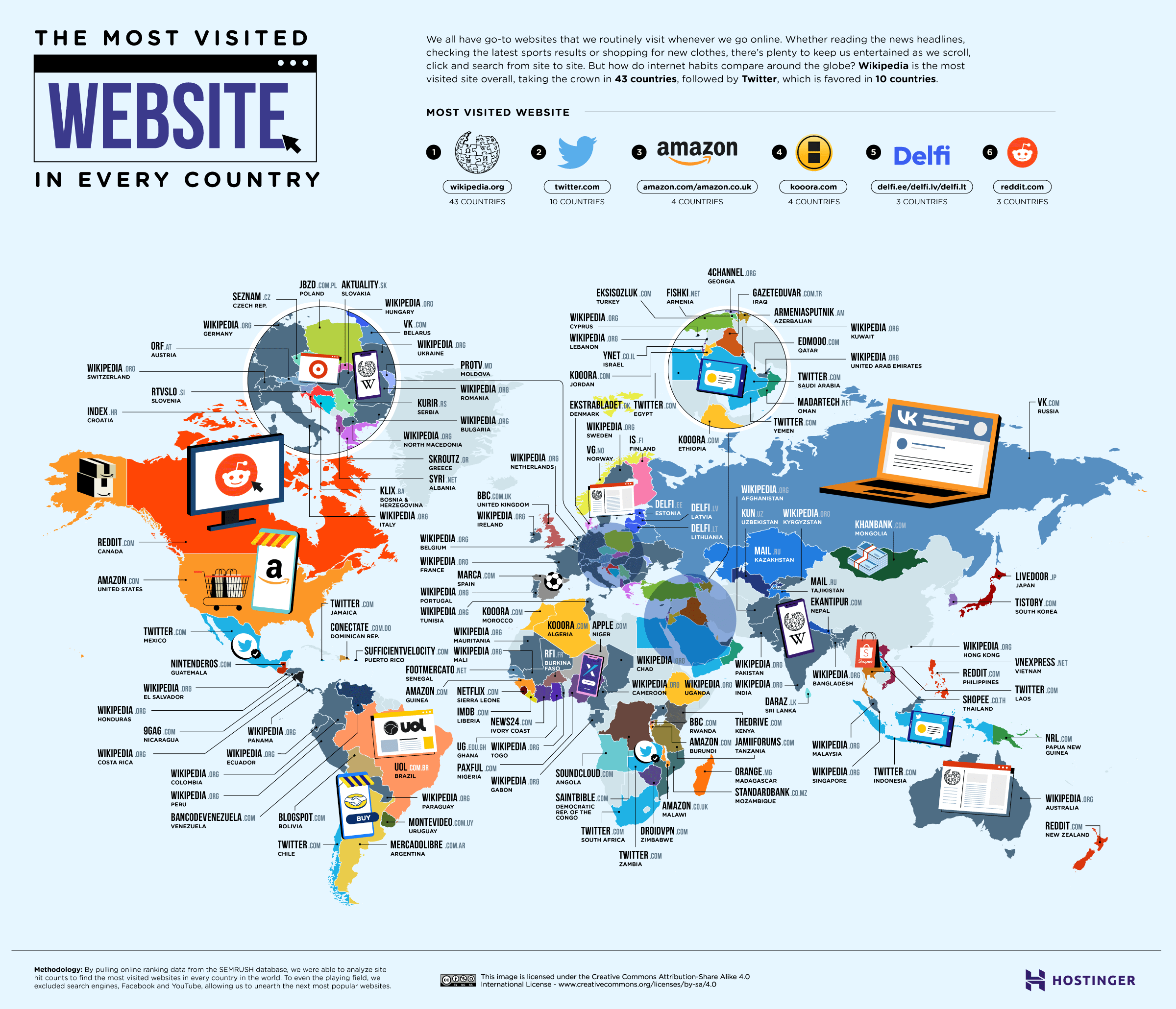

The number of identity theft cases documented by the Federal Trade Commission has grown in 5 years. According to the Federal Trade Commission’s Consumer Sentinel Network report, documented cases doubled from 2019 to 2020.

One likely cause for this upward tendency is the COVID-19 pandemic. Congress enacted legislation that included more than $5 trillion in myriad government benefits. This money was valuable to out-of-luck U.S. citizens, but it was also desirable to scammers who exploited the chance to create fake identities and rob unemployment checks. This past year, the most typical type of identity theft was government documents and benefits fraud.

What else do the numbers tell about the increase in identity theft? Let’s take a closer glance:

- According to Javelin Strategy, 15 million Americans had their identity stolen in 2021; however, most cases went unreported.

- Last year, the Federal Trade Commission received over 1.4 million reports of identity theft. Identity thieves robbed almost $52 billion from U.S. citizens last year.

- Over 40 million American consumers fell prey to identity theft in 2021.

- The most potential targets of identity theft in 2021 were people from 30 to 39 years old.

- Lawbreakers have stolen more than $750 million from taxpayers through the Coronavirus pandemic.

These data only scratch the surface, though. Keep reading to discover more about the latest identity theft data and what you can do to safeguard your private data.

How common is identity theft in the United States

Identity theft is a massive problem in the U.S., and it doesn’t appear to be going away anytime shortly. Fraud reports reveal that the number of identity thefts in the United States persists growing. The chart below displays the number of identity theft reports from the first quarter of 2017 to the first quarter of 2021.

The reported cases of identity theft have increased sharply from just over 100 thousand in the first quarter of 2017 to well over 500 thousand in the first quarter of 2021. 2020 had the most acute growth in reports, as cybercriminals did their best to capitalize on the COVID-19 pandemic to take people’s government help.

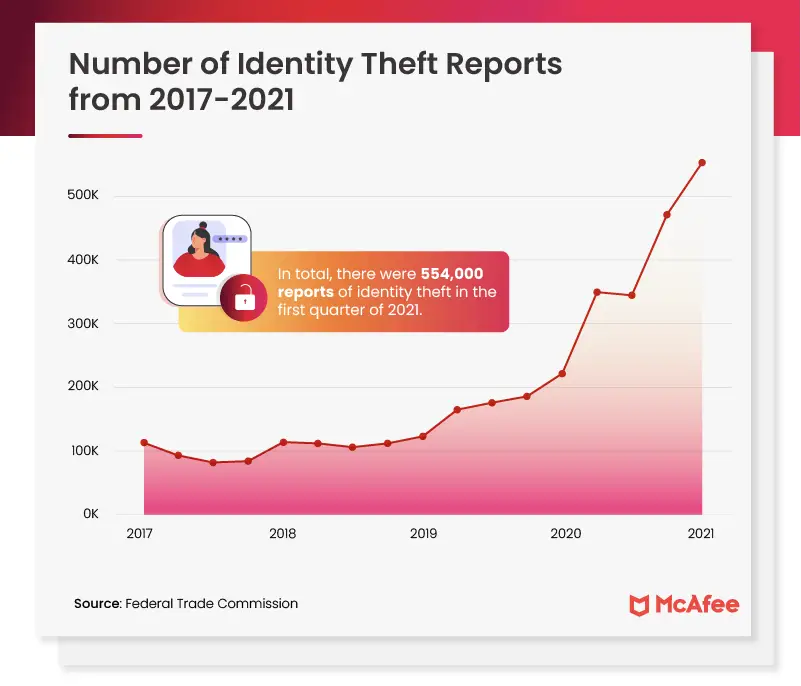

Identity theft, by state

Not every U.S. state is impacted by identity theft equally. Where you live can significantly impact your probability of experiencing identity theft. The map below shows the amount of identity theft instances documented to the Federal Trade Commission per 100 thousand residents in each U.S.

With a closer glance, the 5 U.S. states with the most identity theft reports include Georgia, Louisiana, Illinois, Kansas, and Rhode Island, which take the top place. The number of reports in Rhode Island doubled from 1,191 in 2021 to 2,857 in 2020.

At the other end of the range, South Dakota stayed the U.S. state with the lowest occurrence of I.D. theft, with only 76 residents per 100 thousand experiencing it.

Here’s a list of the 20 metro cities where you have the highest possibility of having your identity thieves.

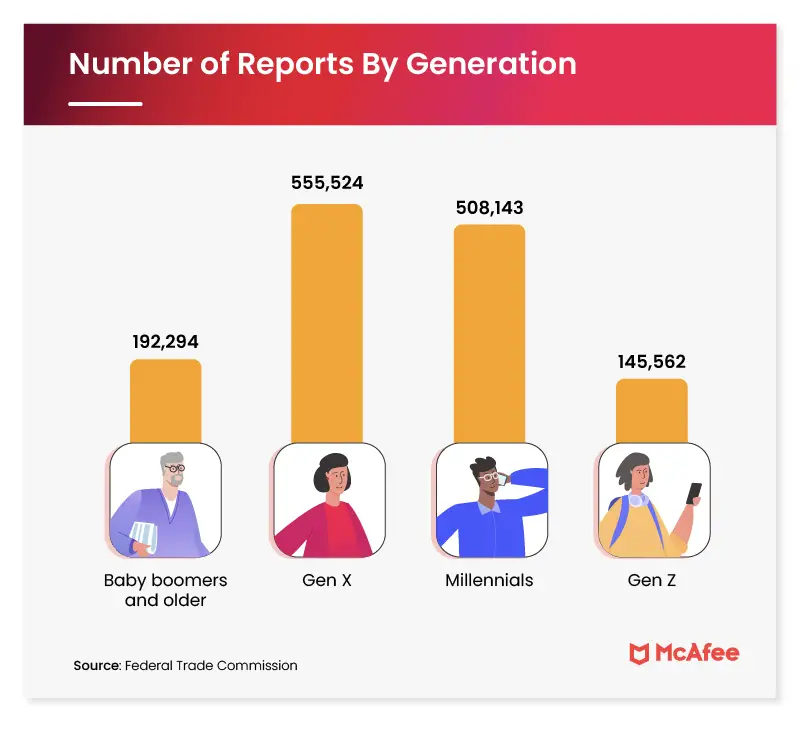

Who are the victims of identity theft?

Anybody can become the target of identity theft, in large part because so much of our information is on the internet. Nevertheless, certain age groups are more likely to experience various types of scams.

For instance, baby boomers are more likely than Generation Z to receive financial help from government programs. This causes them to be more exposed to scams like benefits fraud (where an offender poses as someone else to steal government benefits).

On the other hand, more youthful generations like millennials have been raised with the internet, and activities like shopping online are more common. This makes them more exposed to identity theft through credit card fraud.

Here’s a breakdown of the most typical identity theft types from different generations:

Types of identity theft

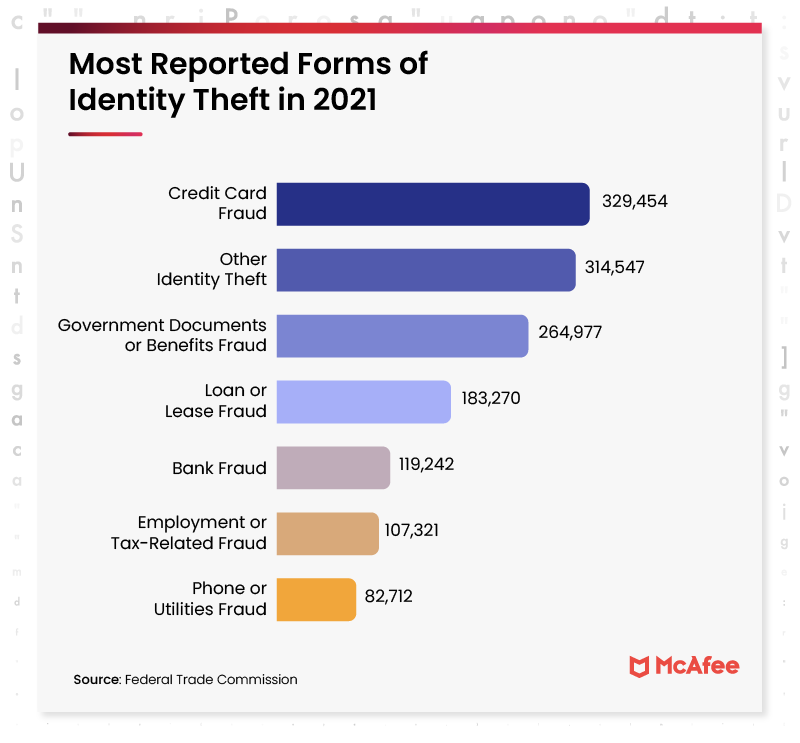

There are several various types of identity theft, varying from stolen financial data to compromised health care information. Some forms are pretty plain. For example, credit card fraud happens when someone steals your credit card number and uses it to purchase things. Other types of identity theft, like medical identity theft, might be more challenging to identify.

Here’s a list of five of the most typical types of identity theft:

- Financial identity theft: This type of identity theft is exactly what it declares and implicates a criminal stealing your financial data. For instance, your credit card information can be stolen and used to create a purchase.

- Medical identity theft: With medical identity theft, somebody thieves your personal data to get health care services. An instance is somebody else utilizing your identity to get prescription drugs.

- Criminal identity theft: This identity theft happens when somebody else operates your name when arrested. You will understand this has happened to you if you receive a court summons, for example, that you had no involvement with.

- Synthetic identity theft: A rising type of identity theft, synthetic identity theft is when somebody makes a fake identity utilizing someone’s real data. For example, a fraud might create a fake identity using somebody else’s actual birthdate and Social Security number to apply for a loan.

- Child identity theft: A criminal uses a minor’s personal information to commit bank fraud or another type of identity theft with child identity theft.

Although these are 5 of the most typical types of identity theft, they can act as umbrella terms for more specific types of fraud. The graph below illustrates the number of reported fraud cases of these different types of identity theft in 2021.

While the internet has made our everyday lives more convenient, it’s also made it much more effortless for scammers to get our confidential information. Identity theft has become increasingly more typical in the U.S. over the past 5 years.

The more you use the internet, the more possibilities scammers have to get your personal information and trade it in places like the dark web. Social media networks, e-commerce businesses, banking companies, and other online enterprises can store your data. If you utilize the internet for online shopping, for example, there’s a good possibility a large number of databases store your personal and financial information. While companies use your data to provide you with a better online experience, scammers can also access it to steal your identity.

The graph below shows the growth of various types of identity theft from 2017 to 2021.

What should I do if I think I’m a victim of identity theft?

Wrongdoers use many schemes to steal your personal information. Hackers and scammers might send phishing emails pretending to be an employee of the Internal Revenue Service, snoop around social media networks for password clues, obtain information through a data breach, or buy data on the dark web

Here are several things you can do if you think you are the prey of identity theft:

- Be on the lookout: To evade identity theft, you will want to be alert for indications that somebody has stolen your identity. Inspect your bank account and credit report regularly to ensure no additional charges to your bank account. Pay awareness to red flags like bills that come to your residence with your data but someone else’s name, weird calls from debt collectors, or emails from new accounts for online services you don’t remember starting.

- Reach out to local law enforcement: Some banks may make you demonstrate them a police report before compensating you for any fraudulent payments or withdrawals.

- Contact the company where your I.D. is being used: Let the companies where your data is used know what happened. For example, you will want to contact your bank and cancel your credit cards if you find out a criminal is utilizing them.

- Get in touch with the 3 significant credit bureaus: Call or message Equifax, TransUnion, and Experian. They may be capable of reducing the consequence an identity thief has on your credit score.

- File a report with the Federal Trade Commission: Reporting identity fraud to the Federal Trade Commission can assist spread attention of scams and identity theft tactics, so others do not fall victim to them.

- Visit the Identity Theft Resource Center: The Identity Theft Resource Center has instruments and information to assist you in defending yourself against identity theft and recovering from it.