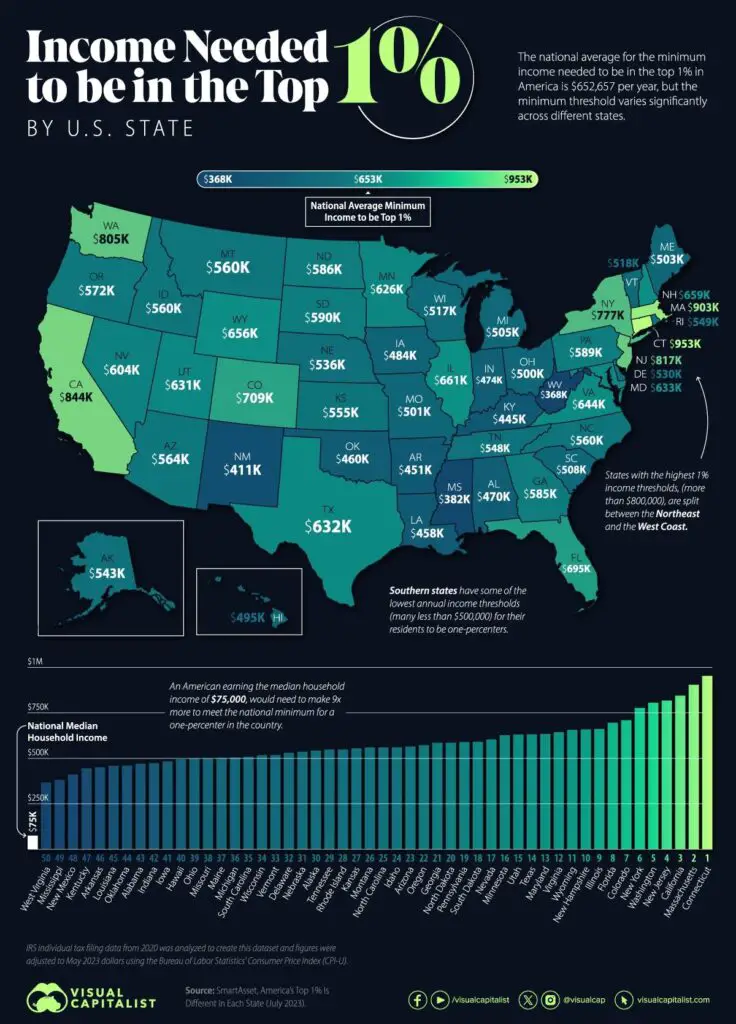

Income Needed to be in the Top 1% in Each U.S. State

This post may contain affiliate links. As an Amazon Associate, we earn from qualifying purchases.

Income inequality in the United States is a complex and persistent issue with profound implications for the nation’s economy, society, and politics. It refers to the unequal distribution of income among individuals and households, where some earn significantly more than others.

Historically, the United States has experienced periods of both higher and lower income inequality. The decades following World War II were characterized by relatively low levels of income inequality due to factors like strong labor unions, progressive tax policies, and increased access to education. However, since the late 1970s, income disparities have grown.

One of the contributing factors to income inequality is wage stagnation for many American workers. While productivity and the cost of living have risen, real wages for the majority of workers have remained relatively flat. This means that many workers are not experiencing significant income growth.

Technological changes and automation have transformed the job market. While technology has created high-paying jobs in certain sectors, it has also displaced workers in traditional industries, contributing to wage disparities.

Education is another critical factor. Individuals with higher levels of education tend to earn more than those with less education. As a result, disparities in educational attainment can exacerbate income disparities.

Racial and gender disparities in earnings are also significant contributors to income inequality. Historically, racial and gender discrimination in the workplace has limited opportunities and wage growth for marginalized groups.

Income inequality is closely tied to wealth inequality, which includes assets like real estate, investments, and savings. The wealthiest Americans often accumulate substantial wealth that generates income, further exacerbating the gap between the rich and the rest.

A significant portion of income growth has been concentrated among the top earners, particularly the highest 1% and 0.1% of income earners. This group has seen substantial increases in income, often driven by factors like executive compensation, capital gains, and investment income. The financial sector has also played a role in income disparities.

Previously, the howmuch.net team made a map that shows the ratio between what the top 1% earns and what the bottom 99% earns. In 2023, the team created the map that shows income needed to be in the top 1% in each U.S. state.

This map was based on a new analysis by the personal finance website SmartAsset, which analyzed 2020 IRS data, adjusted to 2023 dollars.

According to the data, the income required to be part of the top 1% of earners can vary significantly depending on the U.S. state in which you reside. For example, households in Connecticut need to earn an annual income of $952,902 or more to be among the top 1% of earners. This figure is nearly three times the threshold required in West Virginia, where the top 1% income threshold is $367,582.

On a national scale, households earning $652,657 or more are considered part of the top 1%, which is nearly eight times the median household income of approximately $75,000, as indicated by the study’s findings.

States with prominent urban centers, such as California and New York, tend to have higher-earning residents compared to more rural states in the South and Midwest, such as Mississippi or Iowa, based on SmartAsset’s analysis. While residents in these urban states generally earn more, it’s important to note that they also face a higher cost of living, which can partially offset the advantage of higher incomes.

The following list ranks each state based on the household incomes required to be part of the top 1%, from states with the highest income threshold to those with the lowest.

| Rank | U.S. State | Top 1% income threshold |

|---|---|---|

| 1 | Connecticut | $952,902 |

| 2 | Massachusetts | $903,401 |

| 3 | California | $844,266 |

| 4 | New Jersey | $817,346 |

| 5 | Washington | $804,853 |

| 6 | New York | $776,662 |

| 7 | Colorado | $709,092 |

| 8 | Florida | $694,987 |

| 9 | Illinois | $660,810 |

| 10 | New Hampshire | $659,037 |

| 11 | Wyoming | $656,118 |

| 12 | Virginia | $643,848 |

| 13 | Maryland | $633,333 |

| 14 | Texas | $631,849 |

| 15 | Utah | $630,544 |

| 16 | Minnesota | $626,451 |

| 17 | Nevada | $603,751 |

| 18 | South Dakota | $590,373 |

| 19 | Pennsylvania | $588,702 |

| 20 | North Dakota | $585,556 |

| 21 | Georgia | $585,397 |

| 22 | Oregon | $571,813 |

| 23 | Arizona | $564,031 |

| 24 | Idaho | $560,040 |

| 25 | North Carolina | $559,762 |

| 26 | Montana | $559,656 |

| 27 | Kansas | $554,912 |

| 28 | Rhode Island | $548,531 |

| 29 | Tennessee | $548,329 |

| 30 | Alaska | $542,824 |

| 31 | Nebraska | $535,651 |

| 32 | Delaware | $529,928 |

| 33 | Vermont | $518,039 |

| 34 | Wisconsin | $517,321 |

| 35 | South Carolina | $508,427 |

| 36 | Michigan | $504,671 |

| 37 | Maine | $502,605 |

| 38 | Missouri | $500,626 |

| 39 | Ohio | $500,253 |

| 40 | Hawaii | $495,263 |

| 41 | Iowa | $483,985 |

| 42 | Indiana | $473,685 |

| 43 | Alabama | $470,341 |

| 44 | Oklahoma | $460,172 |

| 45 | Louisiana | $458,269 |

| 46 | Arkansas | $450,700 |

| 47 | Kentucky | $445,294 |

| 48 | New Mexico | $411,395 |

| 49 | Mississippi | $381,919 |

| 50 | West Virginia | $367,582 |

Income inequality can have far-reaching social consequences. It can lead to social unrest, limit economic mobility, and negatively impact social cohesion. Addressing income inequality remains a challenging and multifaceted issue that requires comprehensive solutions, including reforms in areas like taxation, education, and labor rights, to create a more equitable society in the United States.

To learn more about the economics, have a look at the following books:

You want to end income inequality .. work harder and make more money.

It’s not that simple. Ending it bit by bit, for one person here or there doesn’t change the systemic problem. To do that we have to accept terms that prevent worse inequality of the Gilded Age, monopolies, union disregarding, passing on intact family fortunes, grifting ala Trump… etc.