How Housing Prices Have Changed Ten Years After The Real Estate Bubble Burst

This post may contain affiliate links. As an Amazon Associate, we earn from qualifying purchases.

The job market is thriving, the stock market is performing well, and the haunting memories of the Great Recession are gradually receding. However, despite the overall economic growth, not everyone is reaping its benefits, particularly evident in the housing sector. Surprisingly, recent data from the U.S. Census Bureau’s American Community Survey for both 2007 and 2017 reveals that many states are still struggling to fully recover from the housing market downturn. In several regions across the country, the housing market has yet to surpass its 2007 levels.

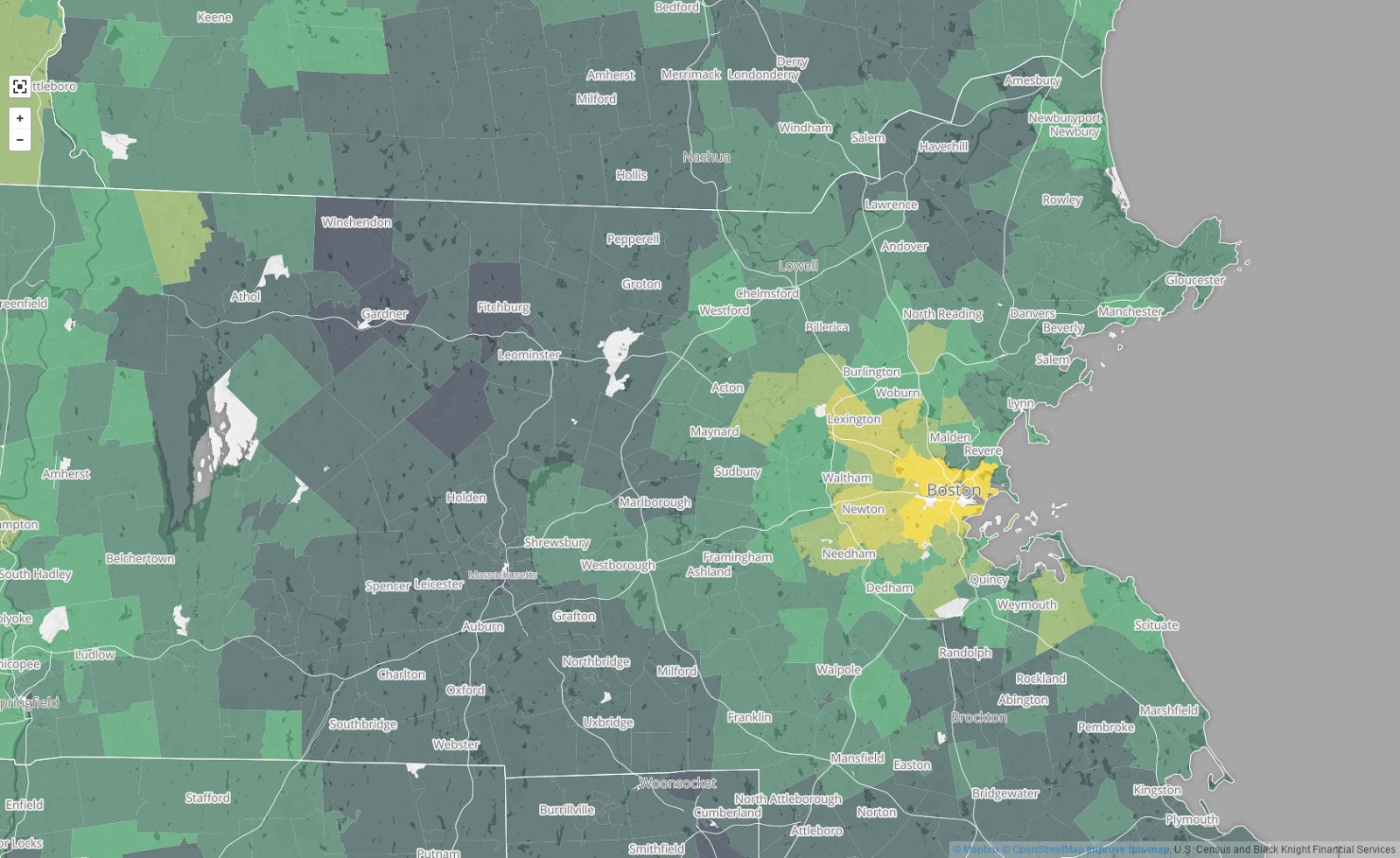

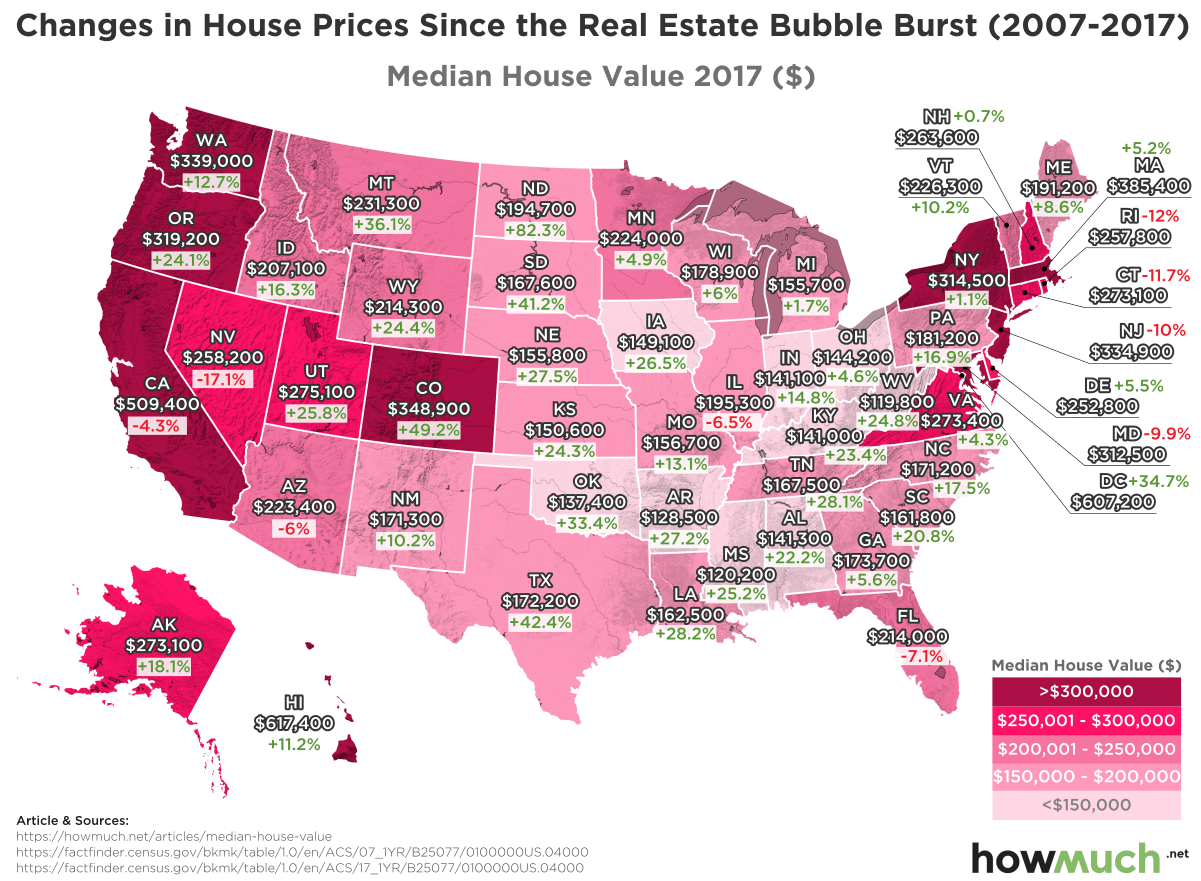

The maps below, created by the howmuch.net team, show the median housing values of each state in 2007 and 2017.

These maps offer a convenient means to swiftly observe a snapshot of the housing market both before and after the Great Recession. The initial image from 2007 presents median home values in a heat map, while the second image depicts prices as of 2017, along with the percentage change in value from a decade earlier. In 2008 and 2009, housing prices experienced a decline in nearly every region across the country.

Pre-bubble, the most affordable housing market was in the central U.S., between the costly West and East Coast. Housing prices, ranging from $106,800 in North Dakota to $120,900 in Texas, were relatively inexpensive. California stood out as the priciest mainland state, with a typical house costing $532,300. The Northeast, centered around New York, housed another cluster of expensive states, while the Upper Midwest around the Great Lakes region fell in between these extremes.

North Dakota (+82.3%), Colorado (+49.2%) and Texas (+42.4%) are among the few states that have seen a much more dramatic increase in housing prices. The median home values of states like Nevada (-17.1%), Rhode Island (-12.0%) and Connecticut (-11.7%) are still lower than they were before the real estate bubble burst.

| State | Median house value, 2017 ($) | Median house value, 2007 ($) | Percentage change |

|---|---|---|---|

| NORTH DAKOTA | 194700 | 106800 | 82.3 |

| COLORADO | 348900 | 233900 | 49.2 |

| TEXAS | 172200 | 120900 | 42.4 |

| SOUTH DAKOTA | 167600 | 118700 | 41.2 |

| MONTANA | 231300 | 170000 | 36.1 |

| DISTRICT OF COLUMBIA | 607200 | 450900 | 34.7 |

| OKLAHOMA | 137400 | 103000 | 33.4 |

| LOUISIANA | 162500 | 126800 | 28.2 |

| TENNESSEE | 167500 | 130800 | 28.1 |

| NEBRASKA | 155800 | 122200 | 27.5 |

| ARKANSAS | 128500 | 101000 | 27.2 |

| IOWA | 149100 | 117900 | 26.5 |

| UTAH | 275100 | 218700 | 25.8 |

| MISSISSIPPI | 120200 | 96000 | 25.2 |

| WEST VIRGINIA | 119800 | 96000 | 24.8 |

| WYOMING | 214300 | 172300 | 24.4 |

| KANSAS | 150600 | 121200 | 24.3 |

| OREGON | 319200 | 257300 | 24.1 |

| KENTUCKY | 141000 | 114300 | 23.4 |

| ALABAMA | 141300 | 115600 | 22.2 |

| SOUTH CAROLINA | 161800 | 133900 | 20.8 |

| ALASKA | 273100 | 231300 | 18.1 |

| NORTH CAROLINA | 171200 | 145700 | 17.5 |

| PENNSYLVANIA | 181200 | 155000 | 16.9 |

| IDAHO | 207100 | 178100 | 16.3 |

| INDIANA | 141100 | 122900 | 14.8 |

| MISSOURI | 156700 | 138600 | 13.1 |

| WASHINGTON | 339000 | 300800 | 12.7 |

| HAWAII | 617400 | 555400 | 11.2 |

| VERMONT | 226300 | 205400 | 10.2 |

| NEW MEXICO | 171300 | 155400 | 10.2 |

| MAINE | 191200 | 176000 | 8.6 |

| WISCONSIN | 178900 | 168800 | 6 |

| GEORGIA | 173700 | 164500 | 5.6 |

| DELAWARE | 252800 | 239700 | 5.5 |

| PURTO RICO | 109800 | 104400 | 5.2 |

| MASSACHUSETTS | 385400 | 366400 | 5.2 |

| MINNESOTA | 224000 | 213600 | 4.9 |

| OHIO | 144200 | 137800 | 4.6 |

| VIRGINIA | 273400 | 262100 | 4.3 |

| MICHIGAN | 155700 | 153100 | 1.7 |

| NEW YORK | 314500 | 311000 | 1.1 |

| NEW HAMPSHIRE | 263600 | 261800 | 0.7 |

| CALIFORNIA | 509400 | 532300 | -4.3 |

| ARIZONA | 223400 | 237700 | -6 |

| ILLINOIS | 195300 | 208800 | -6.5 |

| FLORIDA | 214000 | 230400 | -7.1 |

| MARYLAND | 312500 | 347000 | -9.9 |

| NEW JERSEY | 334900 | 372300 | -10 |

| CONNECTICUT | 273100 | 309200 | -11.7 |

| RHODE ISLAND | 257800 | 292800 | -12 |

| NEVADA | 258200 | 311300 | -17.1 |

In total, median house prices now surpass 2007 levels in 41 states and Washington, DC. However, a closer look at the map reveals underwhelming growth, with 22 states seeing values increase by 20% or less over 10 years. Some areas experienced significant surges, such as North Dakota (+82.3%), Colorado (+49.2%), and Texas (+42.4%), driven by factors like shale fracking and population influx.

Yet, not all states share this positive trend. Nevada stands out, with median home values still 17.1% lower than pre-recession levels. Las Vegas, in particular, lacks appeal for both millennials and retiring baby boomers. Rhode Island (-12.0%), Connecticut (-11.7%), and New Jersey (-10.0%) also remain below their pre-recession levels.