Countries With A Smaller GDP Than Total Bitcoin Market Cap

Bitcoin is a digital currency that operates without a central authority like a government or a bank. Instead, it’s powered by a decentralized network of computers that validate transactions through cryptographic algorithms—a process known as blockchain.

How Big Is Bitcoin Compared to the World?

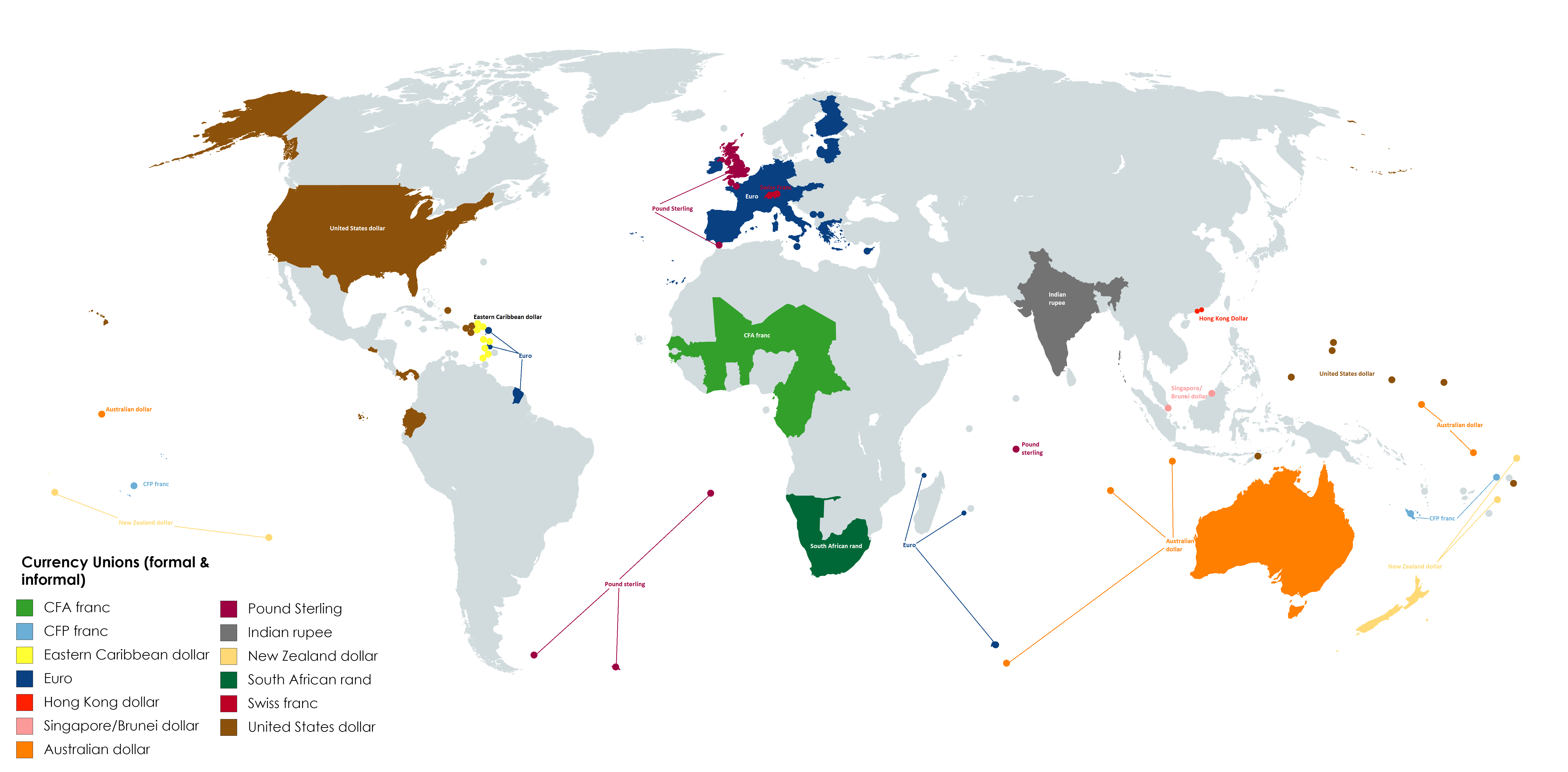

If you’re wondering how big Bitcoin really is, here’s one way to look at it. A world map created by Merchant Machine compares the total market capitalization of Bitcoin—that is, the total value of all bitcoins in circulation—to the GDP of countries around the world.

At the time the map was published (2018), Bitcoin’s market cap stood at USD 116.5 billion, placing it between Kuwait ($109.9 billion) and Hungary ($125.7 billion) in terms of economic size. That would make Bitcoin the 59th largest “economy” in the world. To put that in perspective, the entire Bitcoin network was worth about 0.6% of the United States’ GDP.

This comparison may seem surprising, but it helps illustrate how much value investors have placed on Bitcoin since it was introduced in 2009.

Why Did Bitcoin Become So Popular?

Bitcoin rose to fame for several reasons:

- Decentralization: Many early adopters were drawn to the idea of a currency not controlled by any government.

- Scarcity: Bitcoin has a maximum supply of 21 million coins, which makes it similar to a digital form of gold.

- Speculation: A large part of Bitcoin’s popularity has come from investors hoping to profit from price increases.

- Hedge Against Inflation: In countries with unstable currencies or inflation, Bitcoin has been seen as a potential store of value.

- Tech Culture and Media Attention: From Reddit threads to tech podcasts and mainstream headlines, Bitcoin captured global curiosity.

That said, the path to popularity wasn’t smooth. Bitcoin’s reputation has fluctuated wildly over the years, swinging between optimism and skepticism depending on its price, regulation news, or broader market conditions.

Is Bitcoin Reliable?

That depends on what you mean by reliable.

- As a currency? Not really. Bitcoin’s price is extremely volatile. For example, it dropped from over $68,000 in November 2021 to under $16,000 by the end of 2022, before bouncing back above $40,000 in early 2024. That makes it difficult to use as a stable means of exchange.

- As an investment? Possibly, but it comes with serious risk. Bitcoin doesn’t produce revenue or dividends like a stock. Its value is based entirely on what someone else is willing to pay for it. That’s why some investors call it “digital gold,” while others consider it pure speculation.

- As a technology? Blockchain technology is promising and has inspired a wave of innovation, including decentralized finance (DeFi), non-fungible tokens (NFTs), and various smart contracts. But Bitcoin itself is limited in use compared to newer blockchains like Ethereum.

What Does the Future Hold?

Bitcoin’s future is still up in the air.

- Institutional interest is growing, especially after several spot Bitcoin ETFs were approved in the U.S. in early 2024. That could add legitimacy—and volatility.

- Regulation is also increasing. Some governments embrace Bitcoin, while others restrict or ban it entirely. Clearer rules could stabilize the market or stifle it, depending on how they’re written.

- Environmental concerns remain, as Bitcoin mining consumes large amounts of electricity. Efforts to shift toward renewable-powered mining or more energy-efficient cryptocurrencies are ongoing.

- Adoption might continue to grow—especially in countries with financial instability or limited access to traditional banking. El Salvador, for example, made Bitcoin legal tender in 2021.

In other words, Bitcoin could either become a lasting part of the global financial system—or just a fascinating chapter in economic history.

Whether you see Bitcoin as a bubble, a breakthrough, or something in between, one thing is clear: it’s now big enough to be compared to entire national economies. What do you think? Is Bitcoin the future of money, or just a high-stakes gamble?

Let me know your thoughts in the comments—especially if you’ve used Bitcoin yourself, or live in a country where it’s becoming more popular.