Average Tax Refund in Every U.S. State

A tax refund is the amount of money returned to taxpayers by the government when they have paid more taxes than they owe. The size of a tax refund varies depending on various factors, including income, deductions, credits, and individual circumstances.

In addition to federal income tax, many U.S. states also have their own individual income tax systems. Taxpayers who live in states with income taxes may receive both federal and state tax refunds, depending on their tax liabilities and payments.

According to the latest IRS data, the average federal tax refund is $2,727, but the payouts vary by U.S. state.

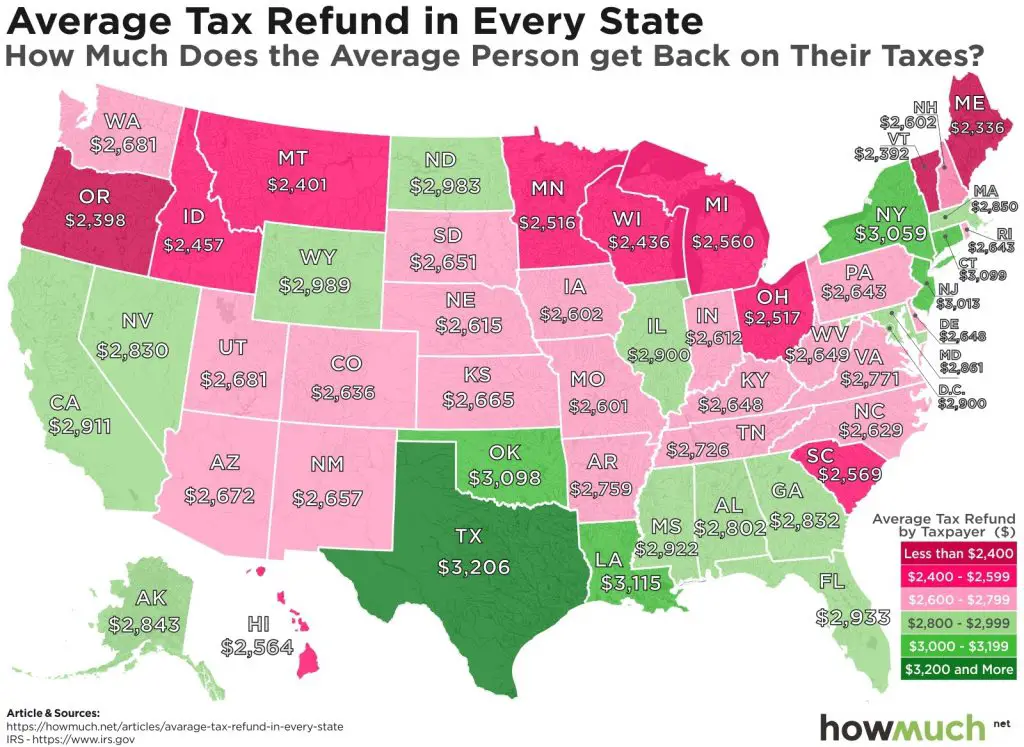

Below is the map created by howmuch.net that shows how much does the average person gets back on their taxes.

According to the map, Texans took home the smallest refunds in 2017, averaging $2,336 per taxpayer, while Mainers took home the biggest ones, averaging $3,206.

| State | Average refund ($) | Number of refunds | Total income tax refunded ($ B) |

|---|---|---|---|

| TEXAS | 3.206 | 10,087,693 | 32.3 |

| LOUISIANA | 3.115 | 1,611,412 | 5.0 |

| CONNECTICUT | 3.099 | 1,396,609 | 4.3 |

| OKLAHOMA | 3.098 | 1,300,577 | 4.0 |

| NEW YORK | 3.059 | 7,712,210 | 23.6 |

| NEW JERSEY | 3.013 | 3,479,321 | 10.5 |

| WYOMING | 2.989 | 214.649 | 0.6 |

| NORTH DAKOTA | 2.983 | 277.422 | 0.8 |

| FLORIDA | 2.933 | 7,854,538 | 23.0 |

| MISSISSIPPI | 2.922 | 1,018,429 | 3.0 |

| CALIFORNIA | 2.911 | 13,594,703 | 39.5 |

| WASHINGTON DC | 2.9 | 277.399 | 0.8 |

| ILLINOIS | 2.9 | 4,973,653 | 14.4 |

| MARYLAND | 2.861 | 2,329,288 | 6.7 |

| MASSACHUSETTS | 2.85 | 2,704,250 | 7.7 |

| ALASKA | 2.843 | 276.887 | 0.8 |

| NEVADA | 2.83 | 1,111,952 | 3.0 |

| GEORGIA | 2.832 | 3,606,774 | 10.2 |

| ALABAMA | 2.802 | 1,650,125 | 4.6 |

| VIRGINIA | 2.771 | 3,129,030 | 8.7 |

| ARKANSAS | 2.759 | 989.288 | 2.7 |

| TENNESSEE | 2.726 | 2,465,816 | 6.7 |

| UTAH | 2.681 | 1,033,141 | 2.8 |

| WASHINGTON | 2.681 | 2,749,362 | 7.4 |

| ARIZONA | 2.672 | 2,244,925 | 6.0 |

| KANSAS | 2.665 | 1,044,275 | 2.8 |

| NEW MEXICO | 2.657 | 724.549 | 1.9 |

| SOUTH DAKOTA | 2.651 | 321.372 | 0.9 |

| WEST VIRGINIA | 2.649 | 649.049 | 1.7 |

| KENTUCKY | 2.648 | 1,590,274 | 4.2 |

| DELAWARE | 2.648 | 365.749 | 1.0 |

| RHODE ISLAND | 2.643 | 436.49 | 1.1 |

| PENNSYLVANIA | 2.643 | 5,071,264 | 13.4 |

| COLORADO | 2.636 | 2,014,233 | 5.3 |

| NORTH CAROLINA | 2.629 | 3,580,471 | 9.4 |

| NEBRASKA | 2.615 | 711.103 | 1.8 |

| INDIANA | 2.612 | 2,577,994 | 6.7 |

| IOWA | 2.602 | 1,141,151 | 3.0 |

| NEW HAMPSHIRE | 2.602 | 558.359 | 1.4 |

| MISSOURI | 2.601 | 2,220,029 | 5.7 |

| SOUTH CAROLINA | 2.569 | 1,719,299 | 4.4 |

| HAWAII | 2.564 | 535.763 | 1.4 |

| MICHIGAN | 2.56 | 3,776,668 | 9.7 |

| OHIO | 2.517 | 4,570,589 | 11.5 |

| MINNESOTA | 2.516 | 2,112,212 | 5.3 |

| IDAHO | 2.457 | 561.133 | 1.4 |

| WISCONSIN | 2.436 | 2,236,886 | 5.4 |

| MONTANA | 2.401 | 372.817 | 0.9 |

| OREGON | 2.398 | 1,431,924 | 3.4 |

| VERMONT | 2.392 | 254.192 | 0.6 |

| MAINE | 2.336 | 509.896 | 1.2 |

For tax year 2022, the average refund nationwide was $3,745.

District of Columbia had the highest average federal refund ($2,452.07).

Idaho was at the bottom of the list for refunds. Taxpayers in this state got back an average of $1,554.54.

To learn more about taxes, have a look at the following books and software:

You realize a tax “refund” is an interest free loan you gave the government for a year … you are wiser if your refund is near zero as to a big refund. A refund means you don’t know how to fill out your W-2.

More withholding than is necessary.

More entrepreneurs v. hourly wage and salary earners.