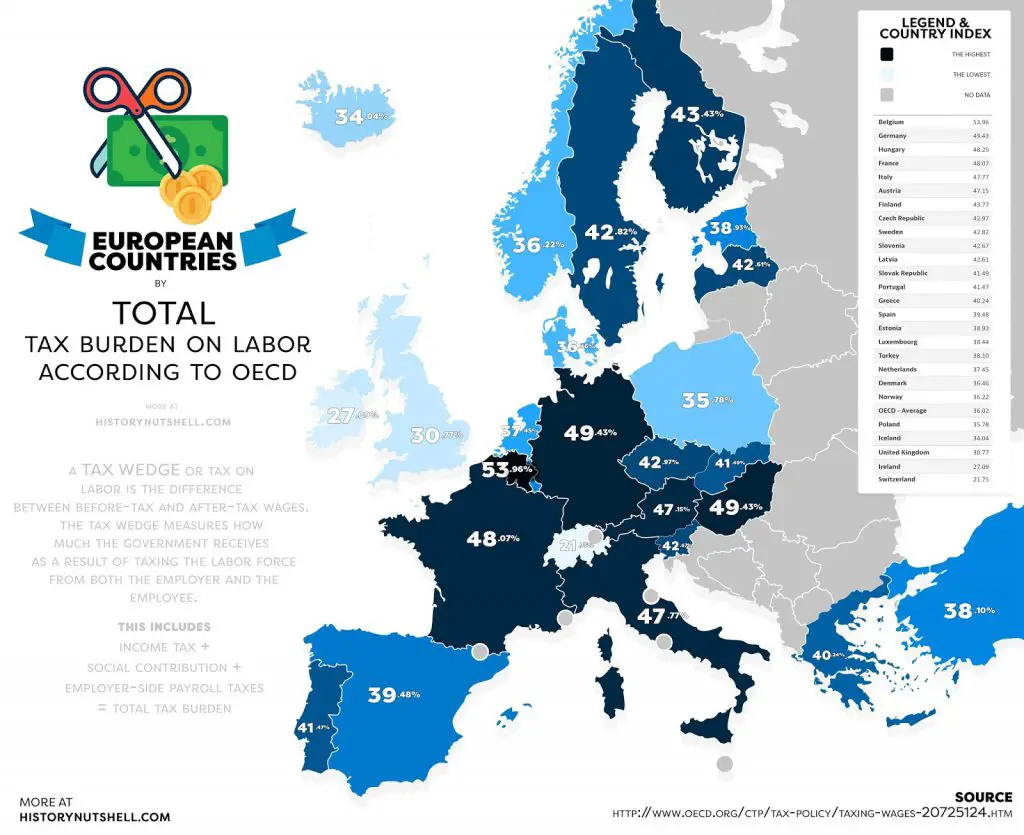

European countries by total burden on labor

Source: facebook.com

A tax wedge or tax on labor is the difference between before-tax and after-tax wages. The tax wedge measures how much the government receives as a result of taxing the labor force from both the employer and the employee.

This includes: Income tax + social contribution + employer – side payroll taxes = total tax burden

Country index:

Belgium – 53.96

Germany – 49.43

Hungary – 48.25

France – 48.07

Italy – 47.77

Austria – 47.15

Finland – 43.77

Czech Republic – 42.97

Sweden – 42.82

Slovenia – 42.67

Latvia – 42.61

Slovak Republic – 41.49

Portugal – 41.47

Greece – 40.24

Spain – 39.48

Estonia – 38.93

Luxembourg – 38.44

Turkey – 38.10

Netherlands – 37.45

Denmark – 36.46

Norway – 36.22

Poland – 35.78

Iceland – 34.04

United Kingdom – 30.77

Ireland – 27.09

Switzerland – 21.75