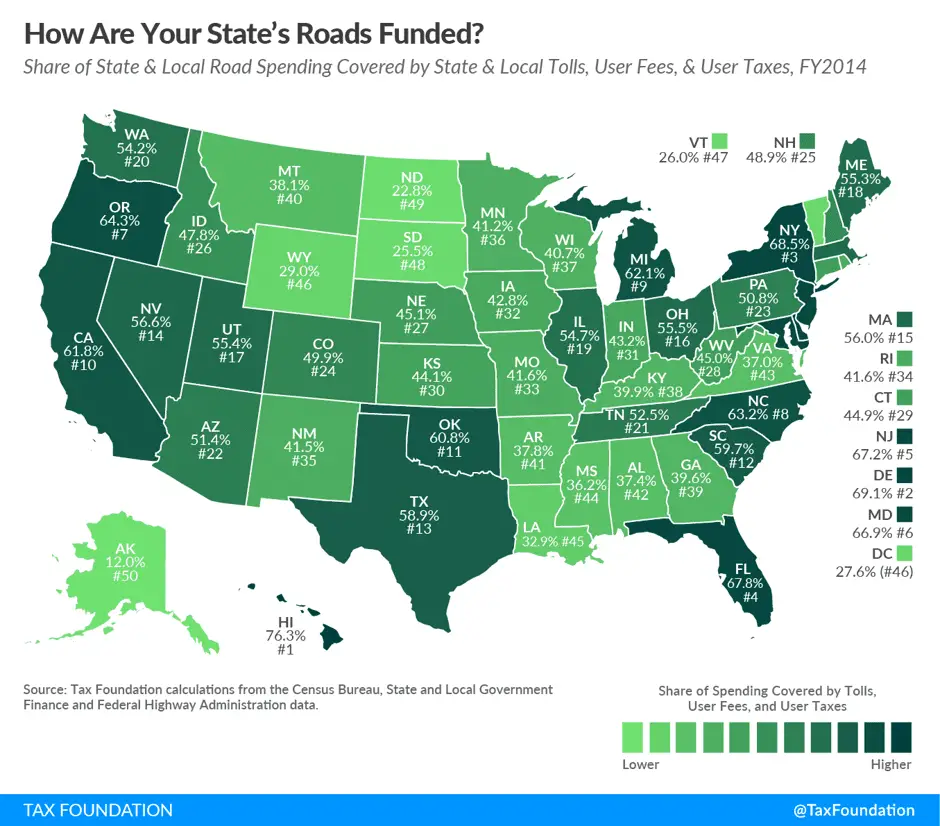

How are your states roads funded?

Share of state and local road spending covered by U.S. state and local tolls, user feed and user taxes.

Gas taxes are typically used to fund infrastructure maintenance and new projects, but the share of state and local road spending that is covered by tolls, user fees, and taxes varies drastically. It ranges from only 12 percent in Alaska to 76.3 percent in Hawaii. States like Alaska and North Dakota (funded 22.8 percent by fees and taxes) keep their transportation taxes low in the same way that they keep all taxes on state residents low, by exporting taxes (primarily through the severance tax).

While much of the rural West and South leans heavily on federal revenues to pay for their roads, Hawaii pays the most out of its own pocket, with hefty vehicle weight fees and sky-high state gas taxes.

Via taxfoundation.org & citylab.com