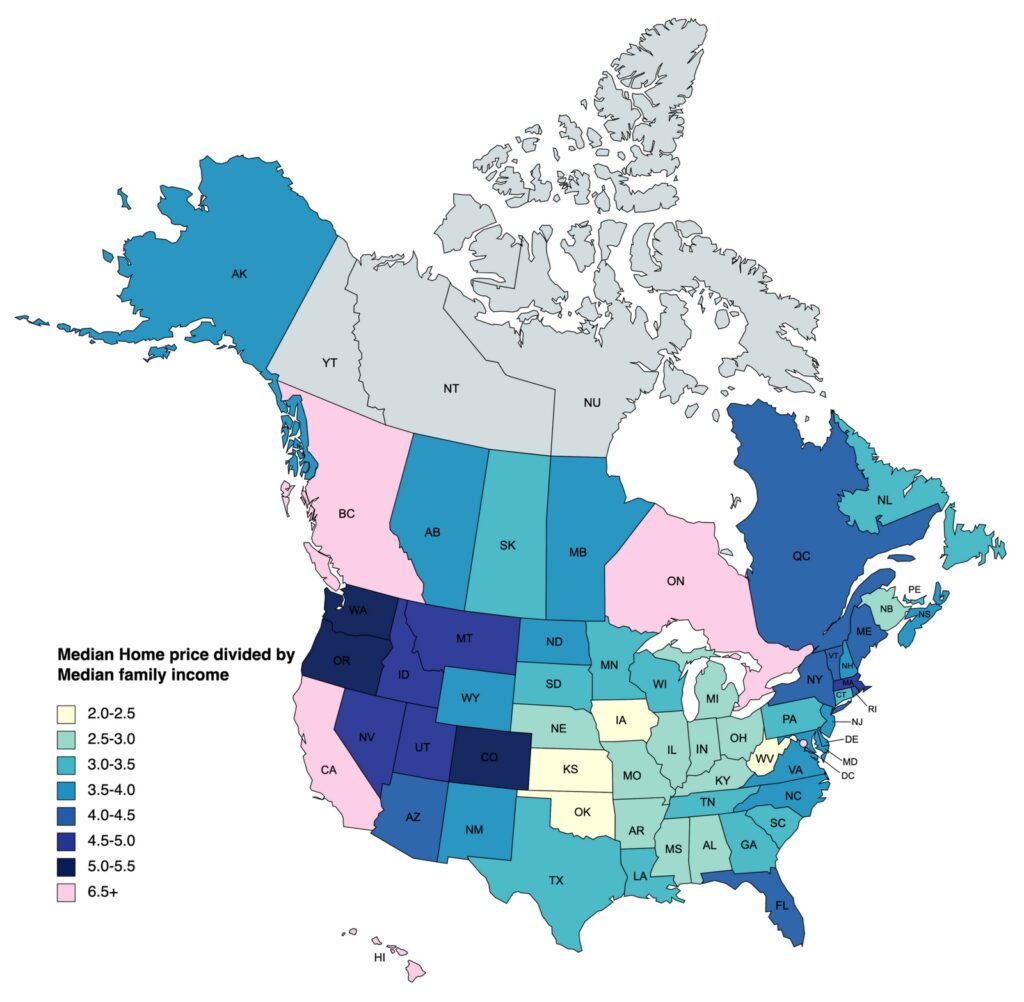

How Many Years You Need to Work to Buy a Home in North America

The housing market across North America varies significantly, with some regions requiring much longer work periods to afford a home than others. A fascinating map created by Reddit user Smacpats111111 highlights this variation by showing the median home price in 2021 (US & Canada) divided by the median family income for each US state and Canadian province. This data shows how many years one would need to work, assuming they spent 100% of their pre-tax income on purchasing a home.

The map reveals striking differences in housing affordability across North America. For instance, it would take approximately 2.2 years of work in West Virginia to buy a house, making it the most affordable state in this analysis. On the other end of the spectrum, British Columbia stands out as the most expensive region, with a staggering 8.7 years required to purchase a home.

| Rank | State or Province | How Many Years To Buy A House |

|---|---|---|

| 1 | British Columbia | 8.68398889 |

| 2 | Ontario | 7.709078 |

| 3 | Hawaii | 7.65867247 |

| 4 | California | 6.89813526 |

| 5 | District of Columbia | 6.79460473 |

| 6 | Oregon | 5.39786454 |

| 7 | Washington | 5.2007066 |

| 8 | Colorado | 5.15798618 |

| 9 | Massachusetts | 4.92592291 |

| 10 | Montana | 4.86065473 |

| 11 | Nevada | 4.76883811 |

| 12 | Idaho | 4.68830637 |

| 13 | Utah | 4.59720243 |

| 14 | New York | 4.46460864 |

| 15 | Arizona | 4.33107727 |

| 16 | Quebec | 4.32752641 |

| 17 | Rhode Island | 4.22667173 |

| 18 | Florida | 4.1394803 |

| 19 | Maine | 4.11234811 |

| 20 | Vermont | 4.03539626 |

| 21 | Alaska | 3.98723878 |

| 22 | New Mexico | 3.92097411 |

| 23 | New Jersey | 3.91373862 |

| 24 | Wyoming | 3.85966802 |

| 25 | Alberta | 3.78365793 |

| 26 | Virginia | 3.73062938 |

| 27 | New Hampshire | 3.72323663 |

| 28 | North Dakota | 3.63925237 |

| 29 | Delaware | 3.62101003 |

| 30 | Nova Scotia | 3.61626551 |

| 31 | Manitoba | 3.61484607 |

| 32 | Maryland | 3.55139616 |

| 33 | North Carolina | 3.52653424 |

| 34 | Prince Edward Island | 3.46880824 |

| 35 | South Dakota | 3.45299246 |

| 36 | Minnesota | 3.44344644 |

| 37 | Tennessee | 3.31583171 |

| 38 | South Carolina | 3.30355523 |

| 39 | Louisiana | 3.26131224 |

| 40 | Georgia | 3.24772507 |

| 41 | Connecticut | 3.24172618 |

| 42 | Texas | 3.23735828 |

| 43 | Wisconsin | 3.14843847 |

| 44 | Saskatchewan | 3.09658467 |

| 45 | Pennsylvania | 3.0664009 |

| 46 | Newfoundland | 3.01470802 |

| 47 | Illinois | 2.9293798 |

| 48 | Michigan | 2.90811292 |

| 49 | Missouri | 2.82993956 |

| 50 | Kentucky | 2.80850942 |

| 51 | Nebraska | 2.78169827 |

| 52 | Mississippi | 2.76253494 |

| 53 | Indiana | 2.70194261 |

| 54 | Alabama | 2.6863378 |

| 55 | Arkansas | 2.61686959 |

| 56 | Ohio | 2.56427134 |

| 57 | New Brunswick | 2.51184328 |

| 58 | Iowa | 2.47823832 |

| 59 | Kansas | 2.42654662 |

| 60 | Oklahoma | 2.36797737 |

| 61 | West Virginia | 2.21568066 |

Here are some key patterns and insights from the data:

- Most Affordable Regions: States like West Virginia, Oklahoma, and Kansas require less than 2.5 years of work to afford a home. These regions benefit from relatively low median home prices combined with reasonable family incomes.

- Least Affordable Regions: British Columbia (8.7 years), Ontario (7.7 years), Hawaii (7.7 years), California (6.9 years), and the District of Columbia (6.8 years) are the most challenging places to buy a home, where high property prices far outstrip median incomes.

Why Are House Prices So High in Certain Areas?

Several factors contribute to the high house prices in British Columbia, Ontario, California, and Hawaii:

- Demand vs. Supply: These regions have a high demand for housing due to desirable living conditions, job opportunities, and amenities. However, the supply of homes has not kept pace, driving prices up.

- Geographical Constraints: Hawaii and California have limited land available for development due to geographical constraints like mountains and coastlines, which further drive up prices.

- Economic Factors: Major cities in these regions, such as Vancouver, Toronto, Los Angeles, and Honolulu, are economic hubs with high-paying jobs. This attracts a large number of buyers, including international investors, contributing to higher prices.

Housing Affordability Trends Over Time

The trend of housing affordability in the U.S. and Canada has been shifting over time, with a general increase in home prices outpacing income growth in many regions. Factors such as low interest rates, increasing demand, and limited housing supply have exacerbated this trend.

Predictions for the Future:

- The U.S.: In the United States, home prices are expected to continue rising, especially in high-demand areas. However, some regions might see a stabilization or slower growth due to potential economic downturns or changes in housing policies.

- Canada: Similarly, Canada is likely to experience ongoing challenges in housing affordability, particularly in major cities. Government interventions and changes in immigration policies might impact future trends.

Explore Maps of North America

For those interested in exploring more about North America’s geography, check out these maps of North America available on Amazon: