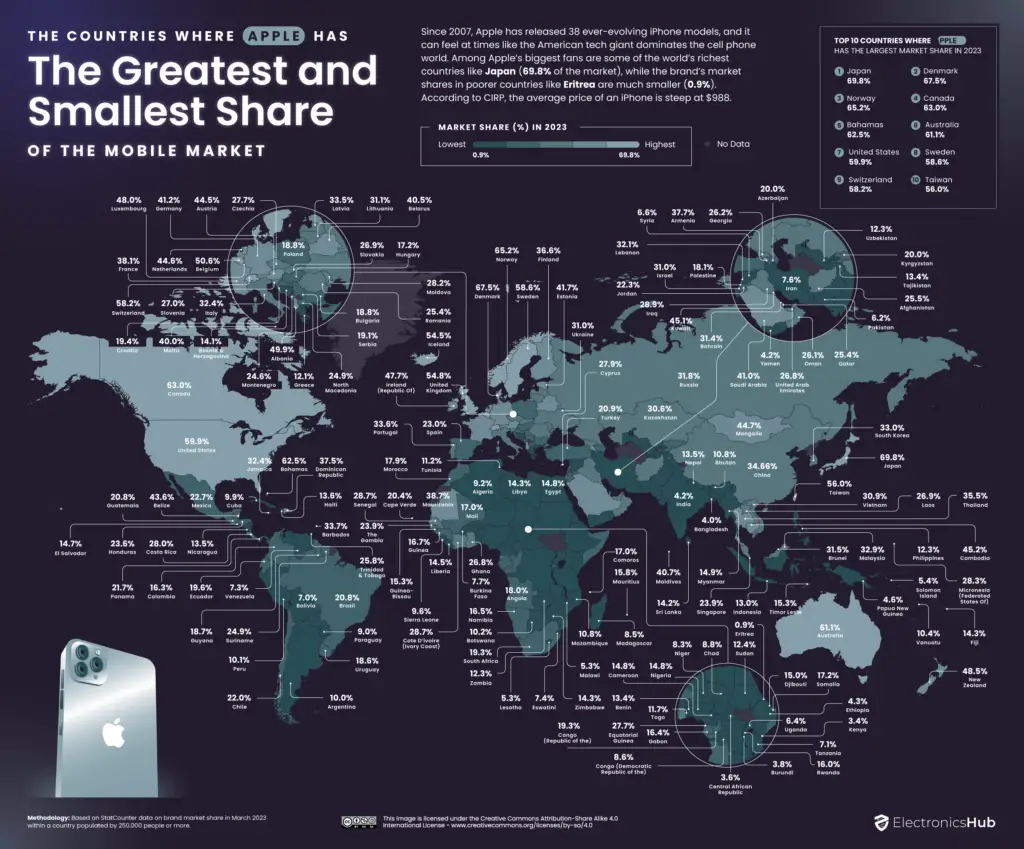

What Mobile Brand Dominates the Market Share in Each Country?

Mobile phones have become ubiquitous, with approximately 7.3 billion people worldwide using them as of 2023, and a notable 85% smartphone ownership rate in the United States. Despite the universal functions of smartphones such as calling, internet access, and photography, the market offers a plethora of models for consumers to choose from.

While affordability is a crucial factor for many, some consumers meticulously research features and capabilities before selecting a specific cell phone model. Others may prioritize a phone’s aesthetics, as a study by the University of Seville revealed that appearance is the most influential factor when choosing a new model.

Brand loyalty also plays a significant role, with Apple and Samsung enjoying particular benefits in this regard. This prompted our analysts at Electronics Hub to explore the global popularity of various mobile phone brands. We examined industry data to identify which cell phone brands dominate the markets in 171 countries and where their popularity has experienced the most significant fluctuations in the past year.

Table of Contents

- Key Findings

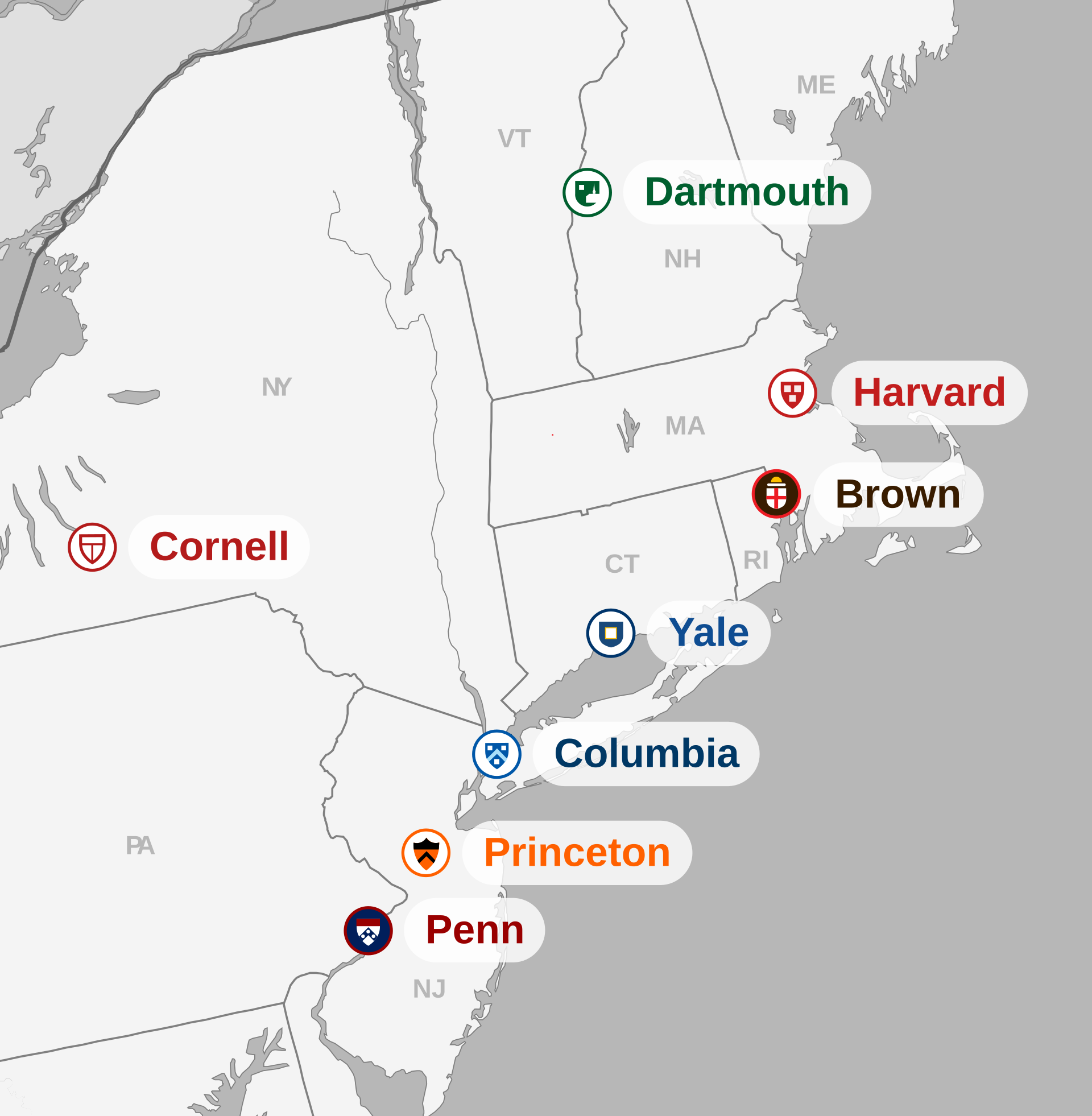

- Which Mobile Brand Has the Biggest Market Share in Every Country?

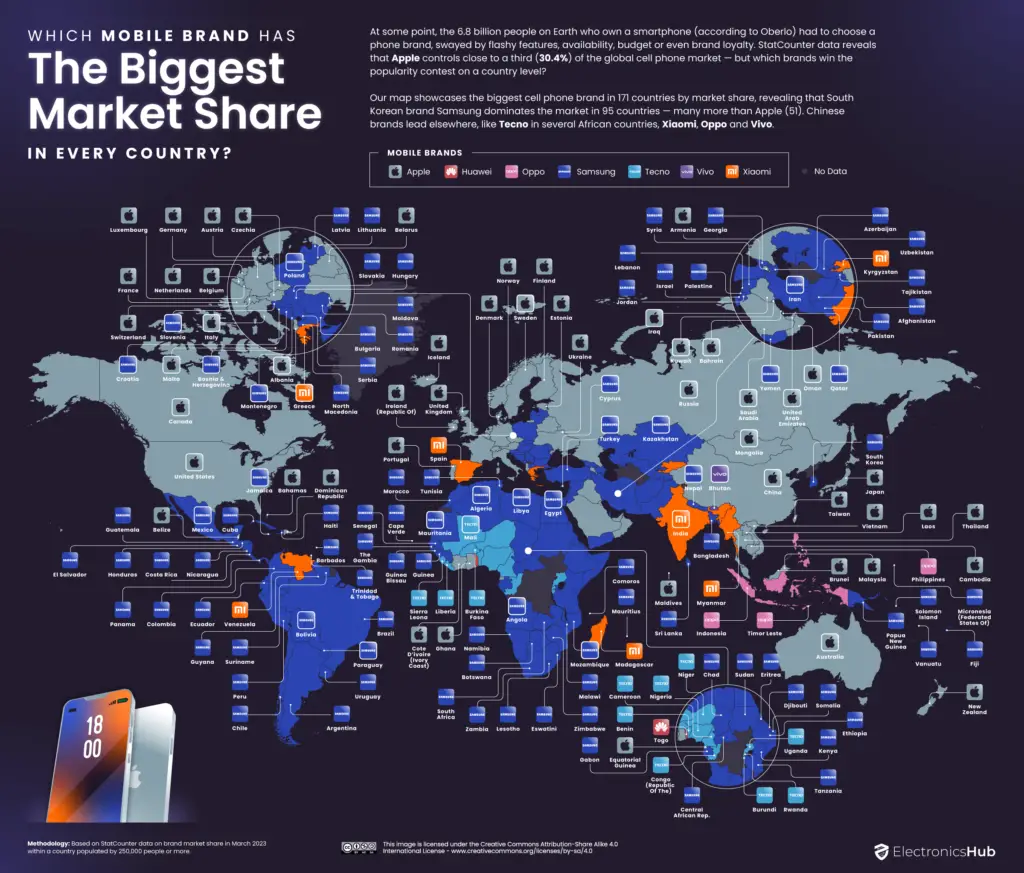

- The Countries Where Samsung Has the Greatest and Smallest Share of the Mobile Market

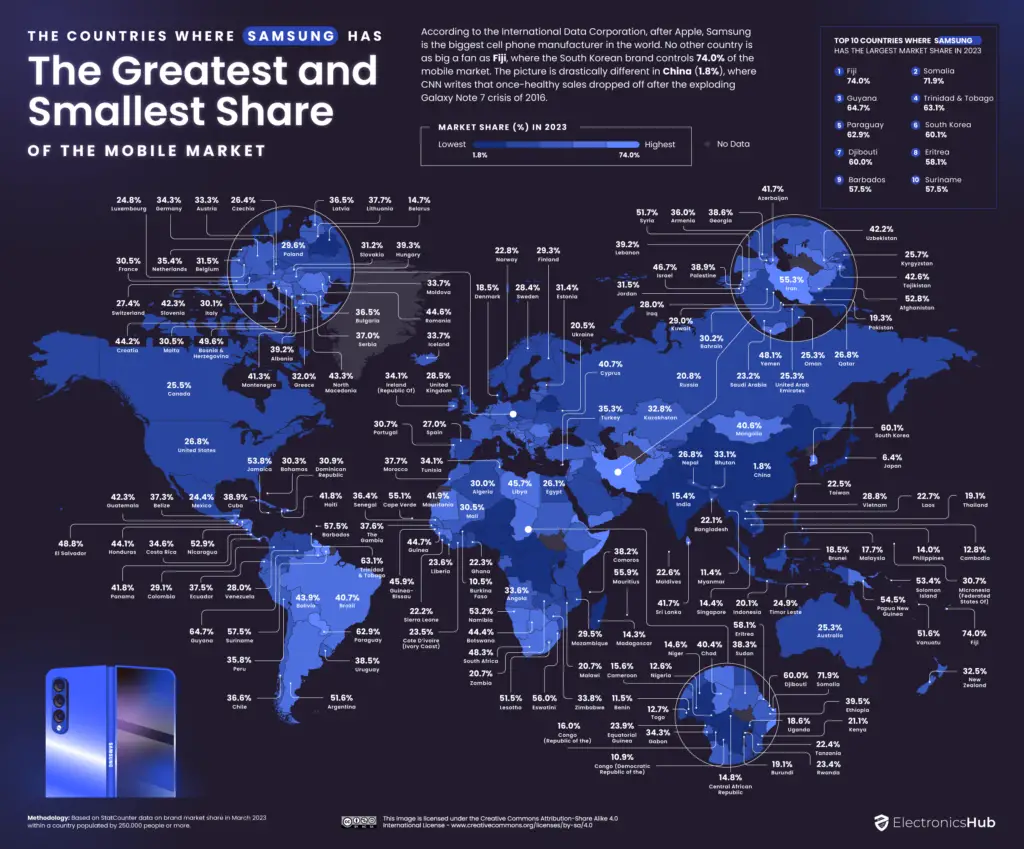

- The Countries Where Apple Has the Greatest and Smallest Share of the Mobile Market

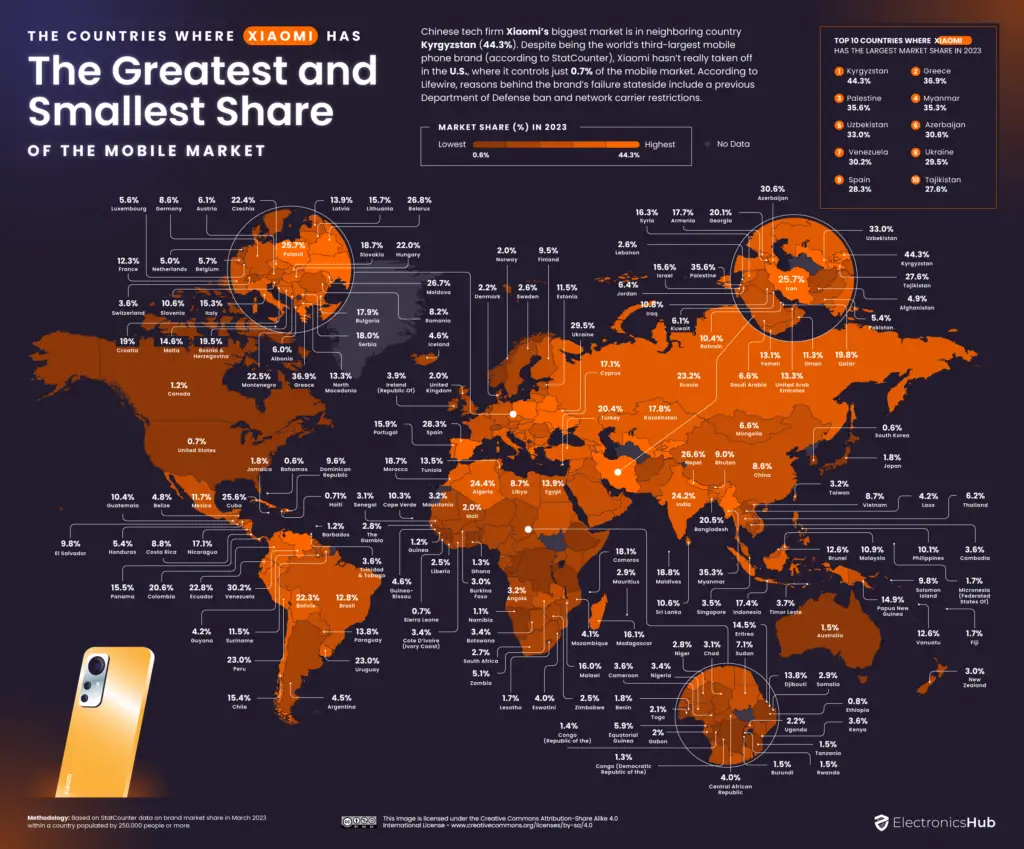

- The Countries Where Xiaomi Has the Greatest and Smallest Share of the Mobile Market

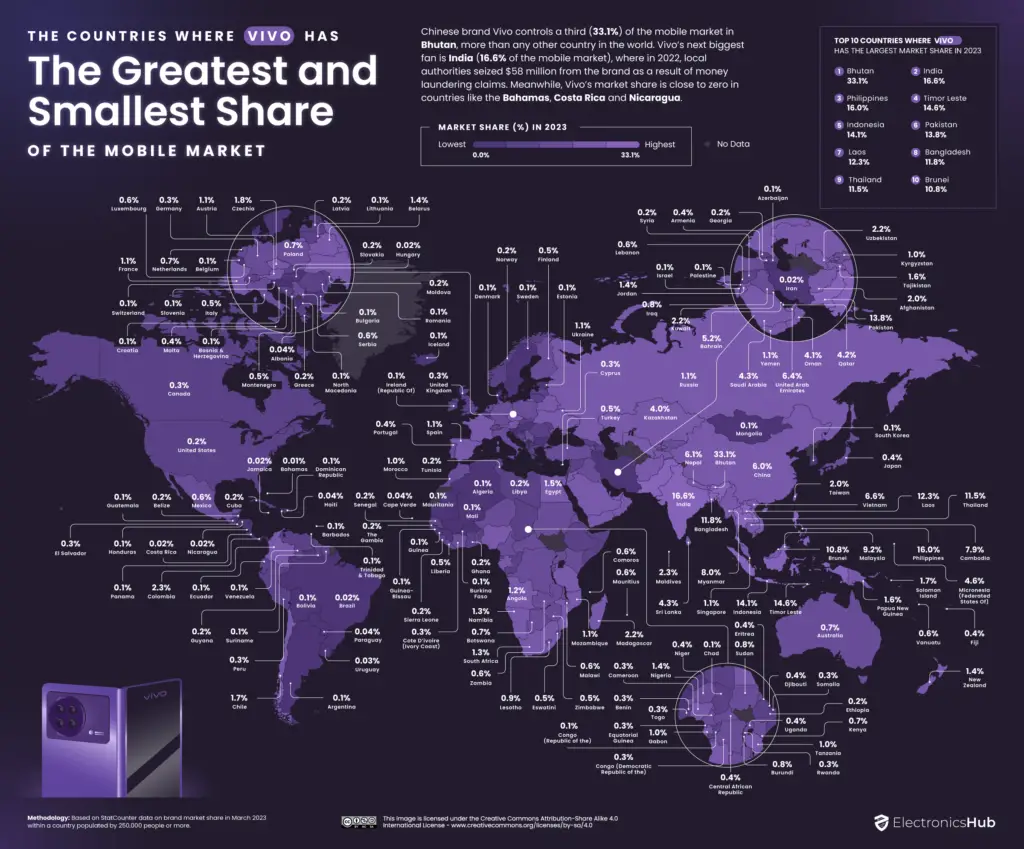

- The Countries Where Vivo Has the Greatest and Smallest Share of the Mobile Market

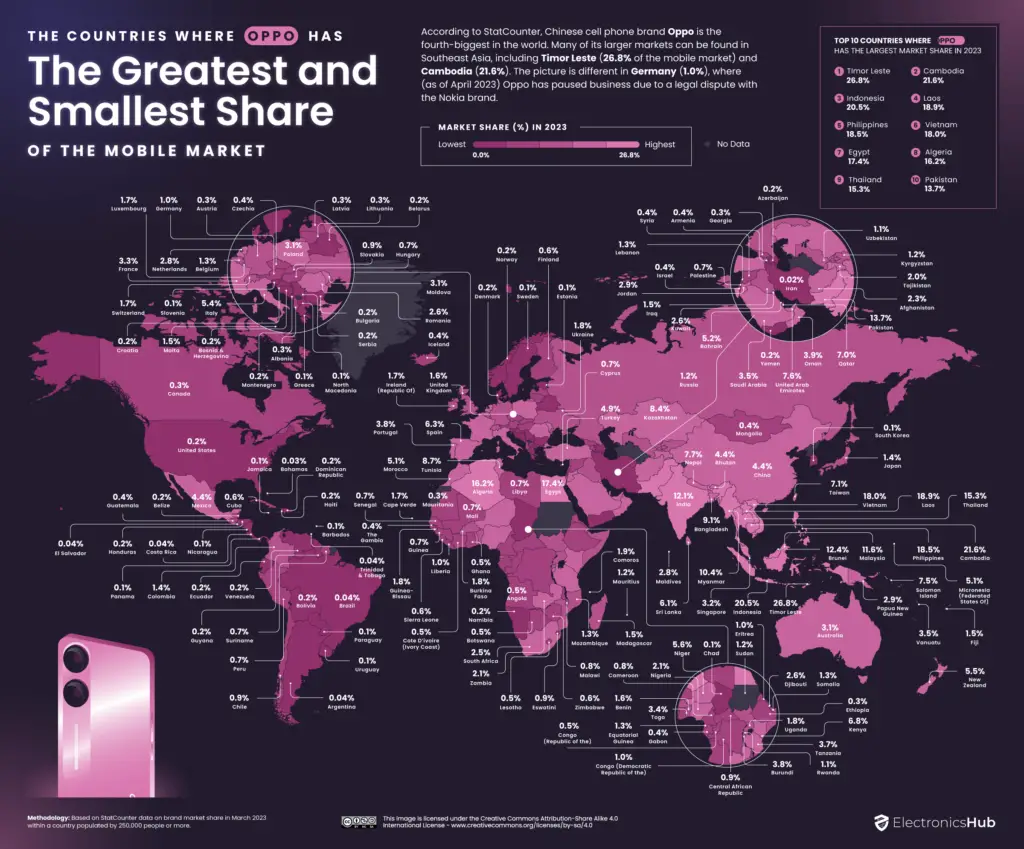

- The Countries Where Oppo Has the Greatest and Smallest Share of the Mobile Market

- The Methodology Behind This Study

Key Findings

- Samsung holds the top position as the leading mobile phone brand in 95 countries, surpassing all other brands in global reach. Furthermore, it boasts the largest market share, accounting for a substantial 74% of the market in Fiji.

- Apple asserts its dominance in 51 countries and commands the most significant market share, with an impressive 69.79% hold on the Japanese market.

- In contrast, Chinese mobile phone brands such as Tecno, Vivo, Xiaomi, Oppo, and Huawei reign supreme in 25 other countries.

What mobile phone brand do you own? If your answer is Samsung, you’re among the majority, as the South Korean company commands the most extensive share of the mobile phone market in 95 countries, surpassing its top competitor, Apple, which leads in 51 countries.

In 2009, the relationship between these two tech giants began to sour as Samsung launched its inaugural Android smartphone, a move that transitioned the company from being Apple’s supplier to becoming a formidable rival. Nevertheless, the mobile phone landscape encompasses more than just Samsung and Apple. Globally, Chinese brands such as Tecno, Vivo, Xiaomi, Oppo, and Huawei command significant shares of their respective local markets. Intriguingly, Apple enjoys dominance in China, where iPhones hold a special status as a symbol of prestige and luxury.

While Samsung enjoys global popularity, it exhibits remarkable dominance in specific regions. Notably, Samsung secures the largest market share in countries like Fiji (74%), where it actively promotes tech education in schools. Other nations where Samsung leads include Somalia (71.89%), Guyana (64.72%), and its home country, South Korea, where it captures an impressive 60.10% of the market.

On the opposite end of the spectrum, China represents a different scenario, with Samsung holding just a 1.78% share of the local mobile phone market, which is lower than in any other part of the world. In recent years, Samsung has faced stiff competition from domestic rivals in China, compounded by a damaging incident involving exploding phones that significantly impacted the brand’s reputation within the country.

During the transition from 2022 to 2023, Samsung experienced the most significant surge in market share, notably increasing by +8.24% in Lithuania. This surge might be attributed to the Defense Ministry’s late 2021 advisory, in which citizens were encouraged to dispose of their Chinese-made mobile phones due to security apprehensions. It appears that Samsung, the South Korean brand, reaped the benefits of these warnings, echoing the sentiments expressed by the country’s Deputy Defense Minister: “Our suggestion is to refrain from acquiring new Chinese phones and to get rid of any previously purchased ones.”

Conversely, Samsung has experienced the most significant decline in its hold on the mobile phone market in Mauritania, with a decrease of -14.29%. The brand has faced its share of challenges in recent months, notably a substantial data breach stemming from employees utilizing the AI program ChatGPT to aid in resolving coding issues.

Apple holds a dominant position in the global smartphone industry, but nowhere is it more popular than Japan, where the American brand captures a remarkable 69.79% of the domestic mobile phone market. According to Apple Magazine, factors behind Apple’s popularity in Japan include vigorous marketing campaigns, desirable iPhone features, and a prevalent anti-Korean sentiment that sees local consumers shun the Samsung brand.

In a landscape where iPhones frequently occupy the top-tier pricing bracket in stores, it’s worth noting that iPhones are relatively more affordable to purchase in Japan. Speaking of pricing, it’s no surprise that Apple’s market dominance extends to wealthier countries like Denmark (67.49%), Norway (65.21%), Canada (62.95%), the United States (59.89%), and Switzerland (58.24%).

Led by Belarus (+19.04%), the top ten nations where Apple’s market share grew the most between 2022 and 2023 are primarily in Europe, where the tech firm has invested €85 billion in regional suppliers over the past five years and “supports over 2.6 million jobs.”

Even as a globally renowned brand, popularity can fluctuate on a regional level. Apple’s hold of the market decreased in several nations between 2022 and 2023, with Greece leading the decrease at -4.64%. The tech giant experienced a dip in sales at the outset of 2023, possibly due to the ongoing global cost-of-living crisis. As reported by the BBC, rising prices have compelled buyers to postpone purchases of computers and iPads.

Xiaomi, the Chinese mobile phone brand, secures the most significant market share in several countries, including Kyrgyzstan (44.33%), Greece (36.86%), and Palestine (35.57%). Notably, Xiaomi’s European debut took place in Spain, where it has also achieved a substantial market share, ranking among the top 10 with 28.34%. Conversely, if you reside in the United States and are unfamiliar with this brand, it’s likely because Xiaomi commands less than one percent of the market there.

For one thing, Xiaomi was the target of a (now lifted) blacklisting by the Trump administration. The brand also doesn’t want to play by carrier network regulations prevalent in the United States; in Hugo Barra’s (Xiaomi’s former Global Vice President) own words: “Brands need a carrier partnership to make inroads in the United States, and Xiaomi is unwilling to do that.”

Between 2022 and 2023, Xiaomi’s dominance of the Eritrean market witnessed a remarkable increase of 12.85% — more than anywhere else in the world. In contrast, Xiaomi’s share of the market declined the most (-7.35%) in Ukraine, perhaps because of the brand being labeled an “international sponsor of war” by Ukraine’s National Agency on Corruption Prevention.

Chinese telecommunications brands like Xiaomi have faced bans and limitations in response to security apprehensions in recent years. In November 2022, the United States formally prohibited the import of specific Chinese telecom equipment, citing concerns about the equipment’s potential threats to national security. Over in Europe, the European Union is actively encouraging more nations to ban Huawei and other Chinese telecommunications brands from using 5G networks.

The Chinese tech company Vivo has secured significant market shares in several Southeast Asia nations, with Bhutan leading the way at 33.10%. Indonesia (14.07%) is also a noteworthy supporter and, according to analyst Risky Febrian, it’s partially because the brand offers “several configurations or models specifically to the preferences of Indonesian consumers.”

Elsewhere, Vivo is not as prominent in other regions. In Germany, the brand holds a negligible market share of just 0.34%, which is likely to drop even further thanks to a total ban because of a patent dispute with Nokia.

Between 2022 and 2023, Vivo saw its hold on the cell phone market in India experienced a notable increase by 1.46%, the 5th-highest rate worldwide. Despite a significant money laundering scandal, Vivo shows no signs of slowing down in India, with intentions to expand its local manufacturing operations.

Conversely, during the same period, Laos (-4.01%), Eswatini (-1.74%), and Malaysia (-1.12%) all find themselves among the countries where the brand’s market share has experienced the most significant declines.

The Chinese brand Oppo holds substantial market shares in several Southeast Asia nations, including Timor Leste (26.79%), Cambodia (21.63%), Indonesia (20.45%), Laos (18.93%), the Philippines (18.47%), and Vietnam (17.95%).

As reported by the South China Morning Post, Oppo and other financially robust Chinese phone brands are thriving in the region because of assertive marketing strategies and affordable handset pricing.

Seven of the top 10 countries that have witnessed the most substantial increase in Oppo’s market share between 2022 and 2023 are located in Africa, with Niger leading the way at +4.10%. It appears that affordable and high-performance Chinese smartphones, such as those offered by Oppo, are contributing to the growth of the continent’s digital economy.

As noted by the former journalist and content creator Ali Muslim, there’s no denying that Chinese smartphone brands have provided individuals like us with a valuable tool for content creation. With a budget of less than $200, you can obtain a quality smartphone equipped with superior cameras, enabling us to produce videos for our online audience.

The Methodology Behind This Study

Electronics Hub conducted a comprehensive analysis to determine the leading mobile brand in every country with a population of 250,000 or more.

The findings are based on market share data from March 2022 to March 2023, obtained from the StatCounter. StatCounter is a platform that tracks 5 billion monthly page views across its network of 1.5 million websites, providing insights into visitor behavior, including the mobile brands preferred by visitors from each country.

The reported mobile brand with the largest market share reflects the situation in March 2023, while the change in market share takes into account the variations between March 2022 and March 2023.