Contactless Card Limits in Every Country

The global financial technology sector persists in expanding at a tremendous rate, with $43.6 billion of investment into the payments space alone in the first half of 2022, according to KPMG. Contactless technology has been a significant contributing element to the sector’s development. Market data from Juniper Research shows that 53% of global card transactions will be completed without the traditional chip and PIN method in the next 5 years.

Contactless payments are made doable with near-field communication (NFC) technology, and the idea first gained popularity on Seoul’s transportation network in the 1990s. By 2003, Transport for London had presented the highly successful Oyster card system to replace paper tickets on its services. It encouraged Barclaycard to offer clients Britain’s first contactless bank card in 2007.

Since then, customers have been feeling more comfy swiping to buy goods and services – with a global Mastercard survey exposing that 8 in 10 consumers are happy to do so. Card transactions are estimated to reach $10 trillion in value by 2027.

Merchant Machine has studied the current global payments landscape to find out.

Table of Contents

Key Findings

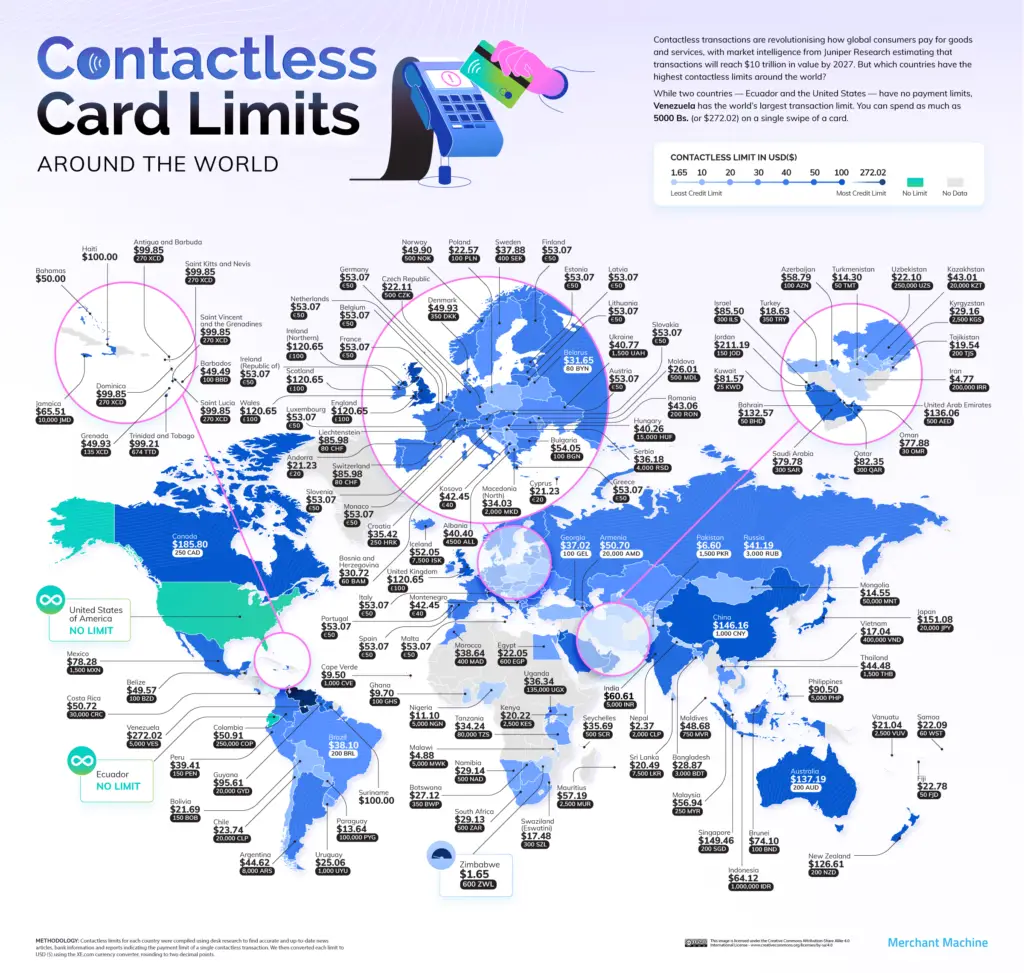

- Venezuela has the highest transaction limit of any nation worldwide, with a limit of 5000 Bs—or $272.02 (£225.59).

- 5 of the 10 highest limits in the world are in Asia, with customers in Japan benefiting from the highest transactions ($151.08 or £125.29) on one card tap.

- The United Kingdom ($120.65 or £100) has one of the highest card limits in the world and the largest in Europe.

- Only 2 nations worldwide, the United States and Ecuador, have unlimited card limits.

Contactless Card Limits Around the World

While two countries — Ecuador and the U.S. — have no payment limits, Venezuela has the world’s most significant transaction limit. You can spend as much as 5000 Bs. or $272.02 on a single card swipe.

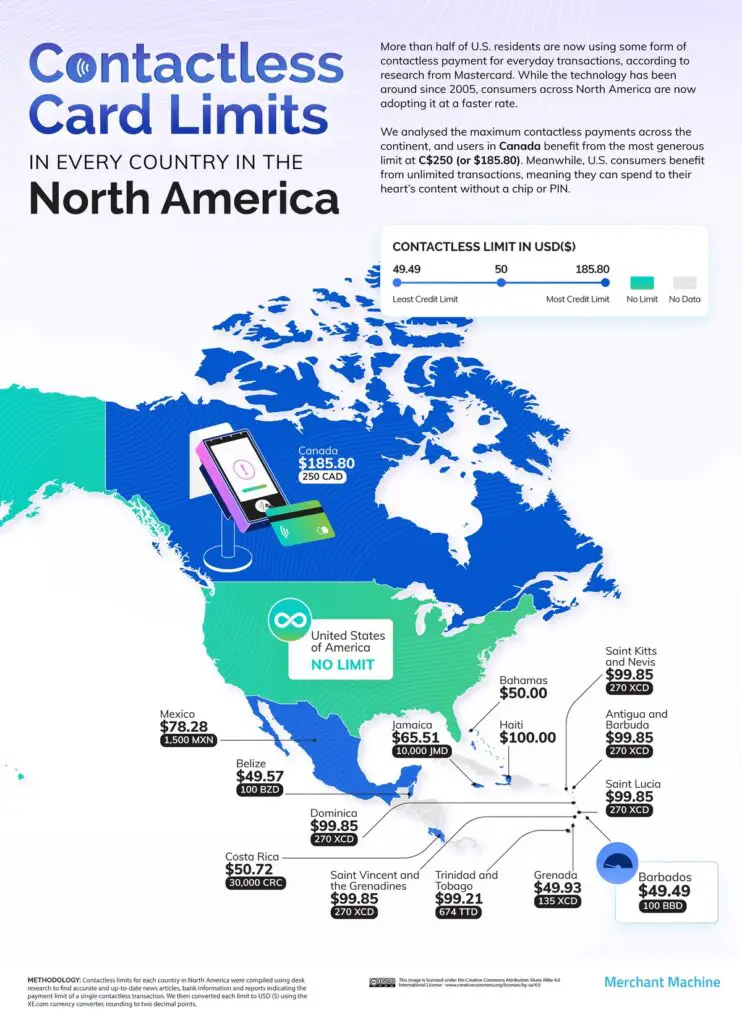

North America

More than half of U.S. citizens are now using some form of contactless payment for everyday transactions, according to research from Mastercard. While the technology has been around since 2005, consumers across North America are adopting it faster.

The Merchant Machine team analyzed the maximum contactless payments across the continent, and users in Canada benefit from the most generous limit at C$250 (or $185.80). Meanwhile, U.S. customers benefit from unlimited transactions, meaning they can spend to their heart’s content without a chip or PIN.

South America

According to Visa, close to 35% of all face-to-face transactions in 2021 were made with contactless technology in South America, with Brazil, Argentina, and Colombia seeing the most significant gains.

Regarding payment limits, Venezuela has the continent’s highest, where consumers can spend as much as 5000Bs. (or $272.02) on a single swipe, people in Ecuador can purchase as much as they like without limits.

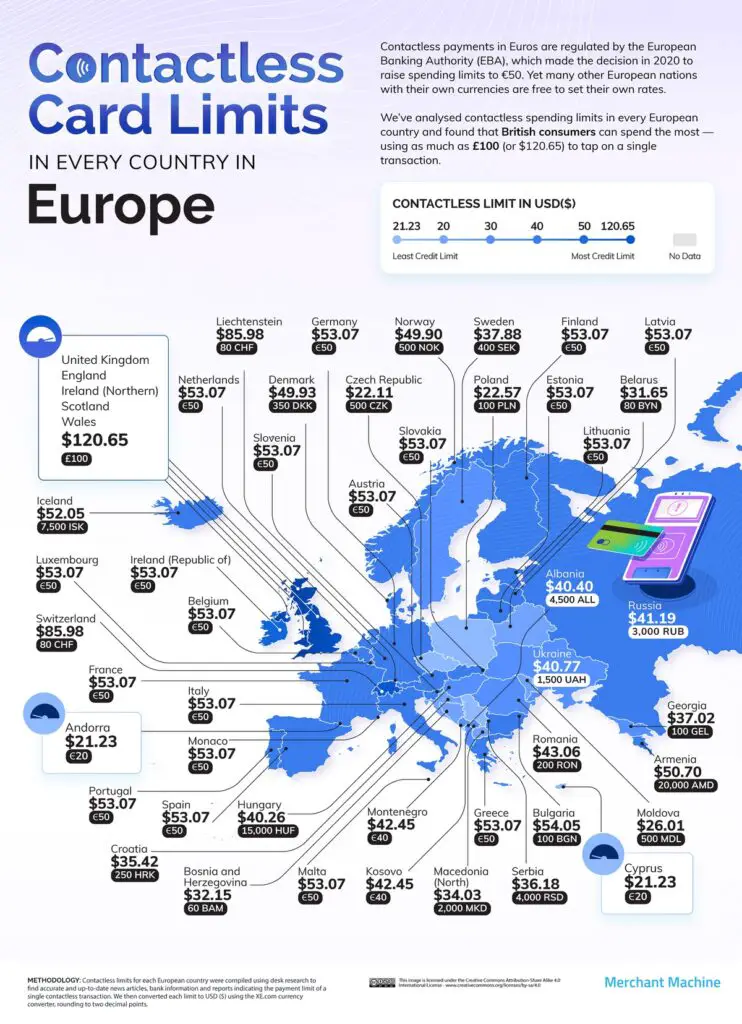

Europe

Contactless payments in Euros are regulated by the European Banking Authority (EBA), which decided in 2020 to raise spending limits to €50. Yet many other European nations with their own currencies are free to set their own rates.

British consumers can spend the most among every Europe country — using as much as £100 (or $120.65) to tap on a single transaction.

Middle East and Central Asia

Despite the Middle East’s digitally savvy reputation, the region is still heavily dependent on cash, with McKinsey analysis showing less than one-third of consumers used electronic payments in 2021. However, we’ve researched every country’s limits for contactless transactions, and Jordanians benefit from the highest limit — being allowed to spend JD 150 (or $211.19) on one swipe.

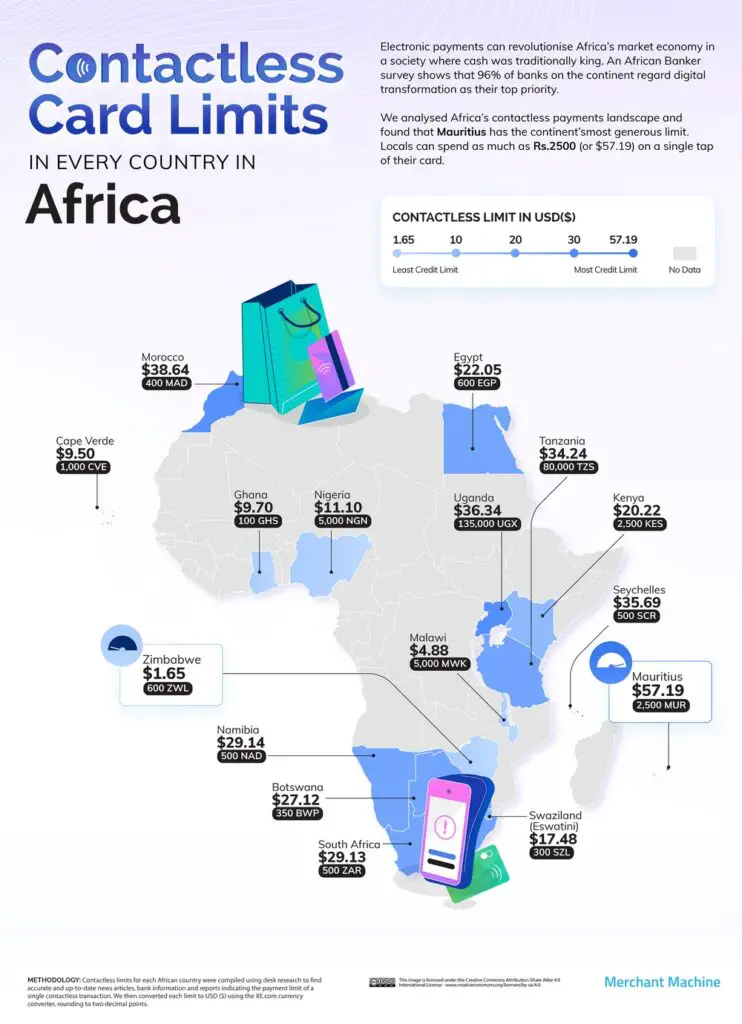

Africa

Electronic payments can revolutionize Africa’s market economy in a society where cash was traditionally king. An African Banker survey shows that 96% of banks on the continent regard digital transformation as their top priority.

Mauritius has the most generous limit in Africa. Locals can spend as much as Rs.2500 (or $57.19) on a single tap of their card.

Asia and Oceania

According to McKinsey, the COVID-19 pandemic triggered a surge in electronic payments across Asia, with a 60% increase in contactless transactions across the continents — double the expected levels.

To find out which Asian countries offer the highest contactless limits on cards, The Merchant Machine team did some research. You can spend ¥20,000 (or $151.08) in Japan without a chip or PIN.

Methodology

To find the contactless card limit for each nation, the Merchant Machine team used desk analysis to find accurate and up-to-date news articles, bank data, and reports revealing the payment limit of a single contactless transaction. This gave them a list of 131 nations in total.

The team then converted each country’s contactless limit to USD ($) using the XE.com currency converter, rounding to two decimal points.

Some nations were excluded from the research if the Merchant Machine team couldn’t find reliable sources of their contactless limit or the country doesn’t yet support contactless payments.

The data and conversions were gathered in November 2022.